Here’s How To Craft Your Family Budget

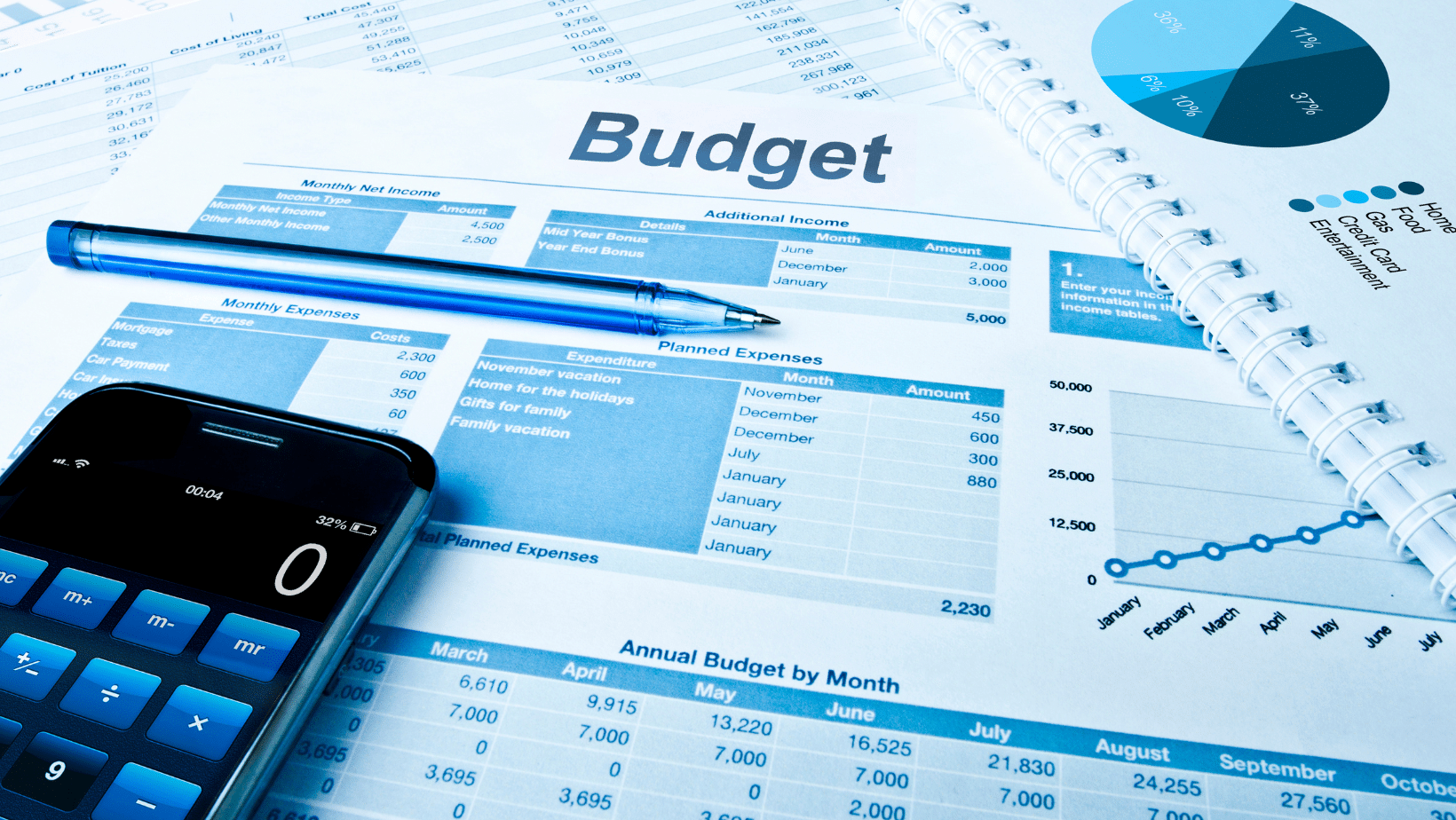

There are several key components that make up a comprehensive financial plan. One topic we’ve been helping many clients navigate within this economic environment is faimly budgeting. Your budget is a crucial and everyday tool in your financial toolkit. It’s the tool that can help you get and stay organized, enabling you to reach your goals and reduce the stress often associated with money. We always say, crafting the perfect budget is both an art and a science, one that requires refining and ongoing effort. In this blog, we will explore some tips and a few vital steps involved in creating a budget that’s not only effective but also adaptable to your personal financial journey.

1. Research: Track Your Spending for a Few Months To Confirm Accuracy

One of the most common issues we see with familys’ budget’s is accuracy. While putting together a budget is great in any circumstance, making sure that it actually reflects your spending is extremely important. So, understanding your financial habits and spending is the first step in creating a budget that works. Over a few months, meticulously track every expenditure, categorizing them into necessities and discretionary spending. This process reveals where your money is going and provides the foundation for your budget

2. Calculate Your Income and Cash Inflows/Outflows

Once your spending is successfully tracked, it’s time to create your financial baseline by calculating your total monthly income, incorporating all sources of cash inflow, whether from your regular job, side hustles, or investments. Create a detailed list of your monthly expenses, encompassing both fixed costs (e.g., rent/mortgage, utilities, insurance) and variable expenses (e.g., groceries, dining out, entertainment). This step should allow you to see everything in one page and help you pinpoint where your budget needs help.

3. Set Realistic Goals

As part of any financial plan, establish clear financial goals so you can utilize your budget as a roadmap to achieve them. Whether you’re saving for a major life event, paying down debt, or building an emergency fund, your goals will drive your budget. Allocate a specific percentage of your income to each spending category in a way that prioritizes your goals but also most importantly comfortably provides for your essential needs.

4. Adjust Your Spending to Stay on Budget

As time goes on, make sure you’re regularly assessing your spending patterns and referring back to your budget. Adjust your spending to align with your cash inflows and income. If you pinpoint an area that is not working in the budget and leaving you with no money at the end of each month, be proactive and make a plan to eliminate or tweak costs within the budget. Ensure that your needs take precedence over your wants to maintain financial stability.

5. Review Your Budget Regularly for Continuous Improvement

A budget is a living spreadsheet that should evolve and grow with your life’s changing circumstances. Consistently review your budget to ensure its current and most importantly, accurate. Track your expenses, compare them to your budget, and make conscious spending decisions. Accountability is the key to achieving the financial goals you are setting out to achieve.

We know that creating a budget can be overwhelming, time consuming, and maybe even stressful. It’s not a one-time task but an ongoing process that can significantly improve your financial well-being. By tracking your spending, calculating your income, setting achievable goals, and regularly reviewing your budget, you’ll build a financial roadmap that will allow you to live your life comfortable, get organized, and reduce some stress that often is related to finances.

As we said, given the current economic environment with higher interest rates, inflation, and a rising cost of living, now more than ever it’s crucial to work on your budget. If you need help tweaking and making adjustments to your budget, we are here and happy to help. Email info@shermanwealth.com or schedule a complimentary intro call here.