Are Inflationary Prices Here To Stay?

Have you been feeling the impacts of inflation over the last 6-9 months? As many of us are starting to spend more money again on things we had been accustomed to pre-Covid, you are likely noticing that costs related to dining, travel, gas, and more have been on the rise. Over the last few months, we’ve been talking a great deal about inflation and the impact it is having on us all.

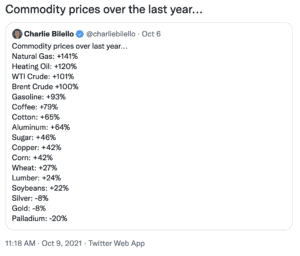

As you may have been seeing in the headlines of CNBC and The Wall Street Journal, higher prices seem like they are here to stay when it comes to Uber and Lyft, FedEx and UPS, and even the dollar store. Last week we even saw US Crude Oil hitting a record high since 2014, reaching over $80 a barrel. We’re not the only ones talking about it- A CNBC article noted that Treasury Secretary Janet Yellen cautioned that inflationary pressures hitting the US economy could last a while.

As we focus on this data and the likelihood of a longer term inflationary impact, how are you feeling about it? Some of you may be not panicking over the increased dollar here or there, but others are certainly feeling the impacts. What’s important to remember during a time like this is to not get overwhelmed, but to adjust your financial plan and budget. Revisit your wants versus your needs and decide what is a priority for you and your family. Since it now costs more to fill your tank with gas, maybe you can scale back on some of your take-out meals. In the event your spending habits change as a result of inflation, it’s key to align your budget with your cash flows and monthly expenses. If you have questions about how to realign your budget and spending habits with your financial goals and current economic situation, email us at info@shermanwealth.com or schedule a complimentary 30-minute consultation here.