Are You Nervous About The Extreme Market Volatility?

Wow, what a rough and volatile week, month, and quarter its been in the U.S stock markets. In fact, the S&P 500 has seen its worst start to the year since the 1930s. We know the volatility within the markets and the Federal Reserve hiking interest rates is uneasy for all; however, as we always say at Sherman Wealth, transparency, communication, financial literacy, knowledge and confidence is extremely important.

So, thanks to our friends at Y-Charts, we will share some visuals of how the stock market has performed over the last few months and since the beginning of the year as it’s been digesting this new economic environment with the Federal Reserve hiking interest rates to combat inflation.

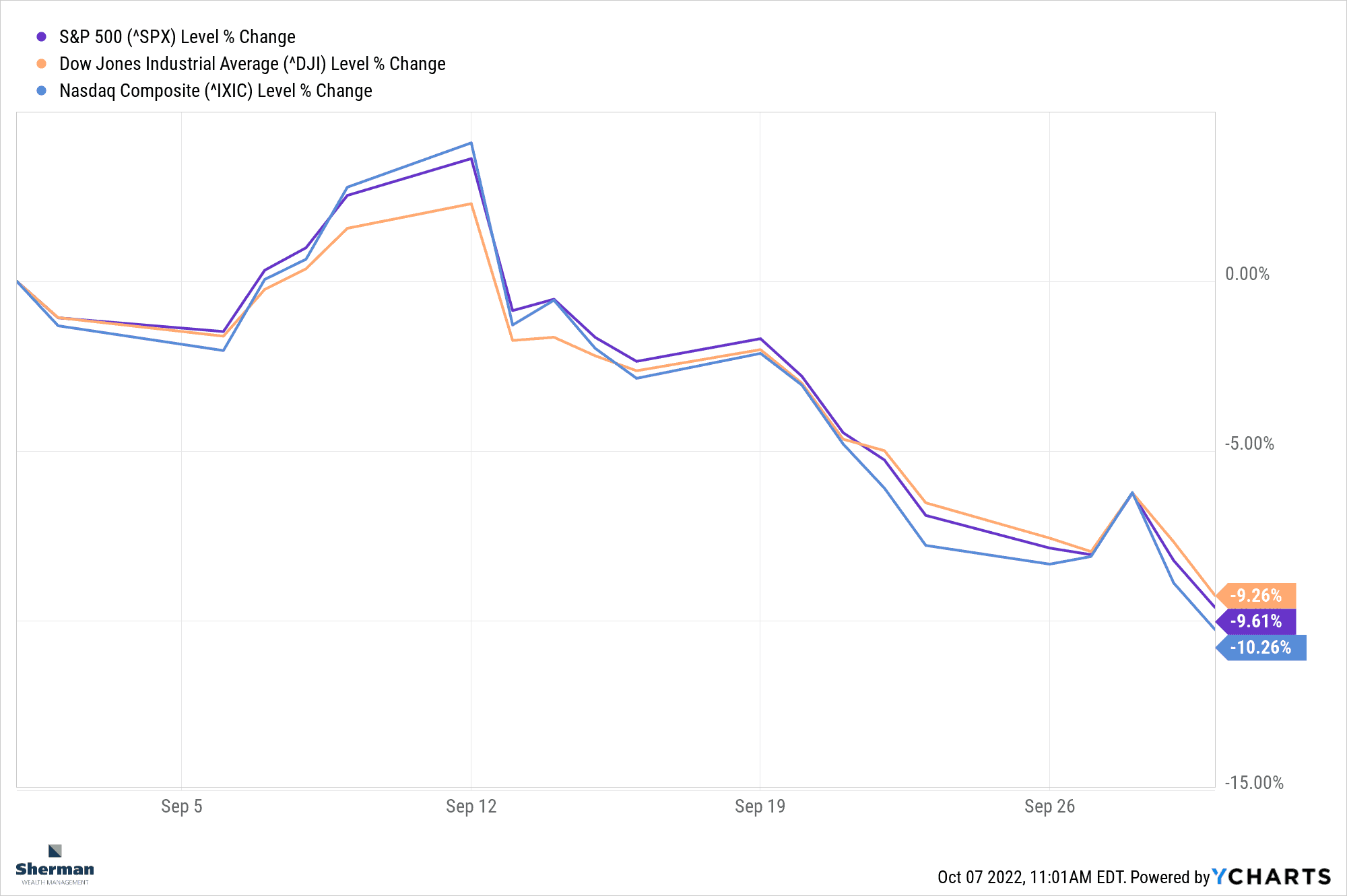

U.S stocks recovered a little to start October after closing out a rough September with consumer prices rosing higher than expected showing that the Federal Reserve still has a lot of work to do to combat inflation. As you can see in the chart pictured above, September had an ugly month, setting a new 2022 closing low ending the month down about 9%.

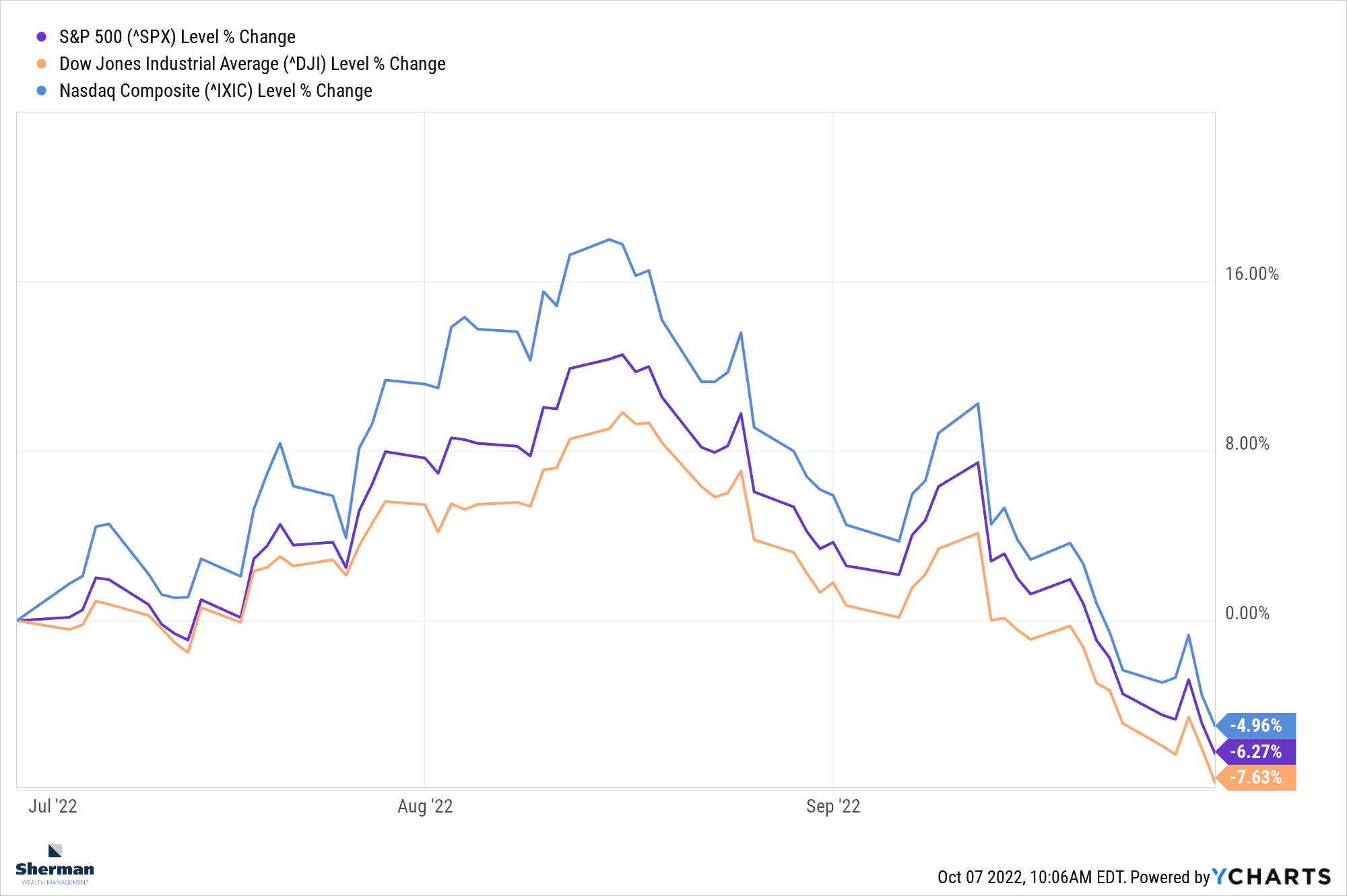

Due to inflation remaining high, Federal reserve officials have made it clear that monetary tightening will continue despite the risk of a recession. Zooming out even further, the stock market saw its worst quarter since 2008, as show in the chart below.

We will continue to monitor the direction of the US economy and stock market as the Federal Reserve continues to do its job to fight inflation. Despite this gloomy economic data, now is the time to get a hold of your finances, to make sure you are comfortable with your risk tolerance and asset allocation, and to make sure you have a sound financial plan in place. If you are extremely anxious and having trouble sleeping at night, this might be your message to revisit your finances and seek help from a financial professional. If you have any questions or concerns, let us know we’re here and happy to help! Email us at info@shermanwealth.com or schedule a complimentary introduction call here.