The last few years have certainly changed the cadence in which many of us operate on a day to day basis. This is especially true with the emergence of technology and transition to remote work, telehealth, and curbside shopping. Another area that has shown significant change is in the use of robo-advisors. While robo-advisors can virtually help you with your finances on a daily basis, a Vanguard survey of 1,500 investors with at least $100,000 in investable assets found that “nearly 90% of robo-advised clients would switch to humans”. Given the current economic environment we are in, adjusting to a higher cost of living and rising interest rates, many individuals have more thoughts and feelings about their finances than ever. In these instances, having a human to vent to and talk through ideas with is so helpful and improves financial confidence.

The survey also found that “more than 90% of human-advised clients say they would not consider switching to a digital advisor, while 88% of robo-advised clients would consider switching to a human advisor in the future.” While digital advice can get the job done, there is something to be said about the human connection that develops between an advisor and their client.

I would say it’s quite difficult to establish trust, loyalty, and a relationship with a digital robot, which is what differentiates the robo-advisor from working with a human advisor. In fact, the survey discovered that loyalty within those who work with a human advisor is unmatched to those who are currently utilizing a robo-one. It is interesting to see that even though our society has transitioned a huge chunk of our lives online, human interaction within the financial industry is still the trusted and preferred method.

At Sherman Wealth, we specialize in behavioral finance, which goes beyond just the quantitative aspect of investing that a robot can properly assist with. We customize each and every financial plan to fit the needs of each client. No one client is the same so their advice should not be generalized, rather tailored to fit their specific needs. In a world where the economy is ever-changing, having a pro-active and trusted professional to hold you accountable and constantly update your financial roadmap far outweighs an online robot. Studying the behavioral aspects of our clients allows us to build connections with them, uncover hidden complexities, and truly understand their biases and relationship with money and investing. We take pride in our 24/7 accessibility and being a “financial concierge”.

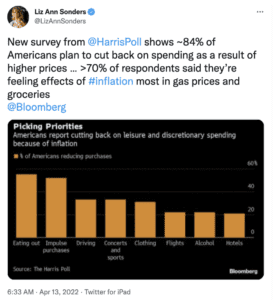

Given the rollercoaster we saw in the markets last year and the extreme volatility we’ve experienced, personalized advice is more prudent now than ever. With rising interest rates and this inflationary economy, having a financial roadmap and guidance can help you navigate this climate. If you haven’t done so, think about re-visiting your financial plan, whether its adjusting your budget for inflation, checking in with your asset and risk allocation, or just an overall check-in. If you haven’t done so already and we head into February, set some financial goals for yourself to achieve before the end of the year. If you need help or even just a sounding board to bounce ideas off of, we’re here to help! If you have any questions about your financial situation or current method of advice, email us at info@shermanwealth.com or schedule a complimentary intro call here.