Launch Financial- Biden’s First 100 Days and Earnings Season

Check out this episode!

Check out this episode!

Join us on this week’s episode of Launch Financial as we wrap up financial literacy month with Dr. Genevieve Floyd and Maria Tarasuk, both MCPS professionals. On this week’s episode, Dr. Genevieve Floyd and Maria Tarasuk discuss how Montgomery County Public Schools are instituting financial education in their curriculum and how to better financial literacy…

On this week’s episode of Launch Financial, we are joined by a recurring guest, David Pearl. This week, David helps us discuss financial literacy and the importance of establishing or passing down financial traditions to your family. Throughout the episode, Brad, Ashley and David discuss their own personal experiences with these family traditions and ways…

Check out this episode!

With tax day fast approaching, many people are counting on receiving a big check back from the Government. While you’re probably looking forward to this windfall, there are reasons why you may wish to minimize your end-of-year refund. Why Big Refunds are Bad Taxes are refunded to you when the Government takes too much of…

Check out this episode!

On this week’s episode of Launch Financial, we are joined by special guest Dr. Josh Funk, Founder and CEO of Rehab 2 Perform. Throughout the episode, Josh shares his experiences creating and expanding his small business and how he has learned to adapt in an ever-changing landscape of the business world and COVID-19. A little…

Check out this episode!

Join us on this week’s episode of Launch Financial as we are joined by The Washingtonian Group’s Andres Serafini and Daniel Esteban. On this episode, Andres and Daniel will share tips on how to compete, plan, and protect yourself in such a hot real estate market. For more information on Andres and Daniel check out…

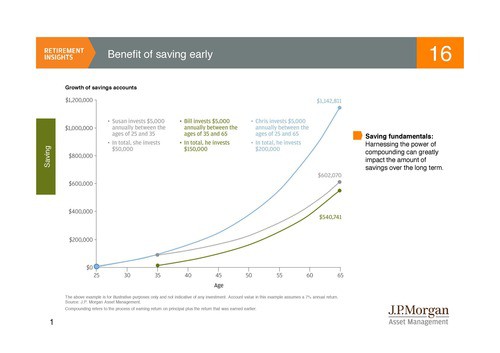

Combining asset allocation and early regular savings today helps to prevent playing the catch up game tomorrow. Contact Sherman Wealth Management for an investment strategy that, with periodic review, will potentially maximize your savings in the long-run with respect to your individual tolerance for risk. We can show you the benefit of saving early for…