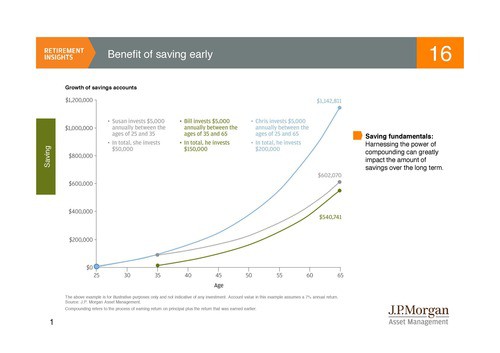

The Benefits of Saving Early For Retirement

Combining asset allocation and early regular savings today helps to prevent playing the catch up game tomorrow. Contact Sherman Wealth Management for an investment strategy that, with periodic review, will potentially maximize your savings in the long-run with respect to your individual tolerance for risk. We can show you the benefit of saving early for…