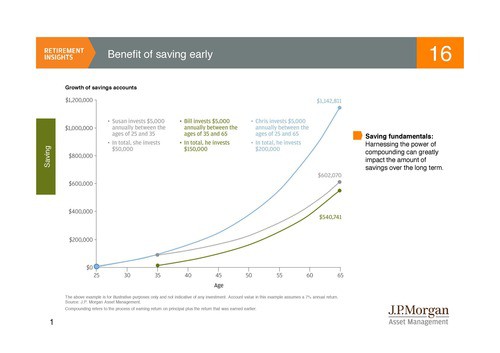

The Benefits of Saving Early For Retirement

Combining asset allocation and early regular savings today helps to prevent playing the catch up game tomorrow. Contact Sherman Wealth Management for an investment strategy that, with periodic review, will potentially maximize your savings in the long-run with respect to your individual tolerance for risk. We can show you the benefit of saving early for retirement.

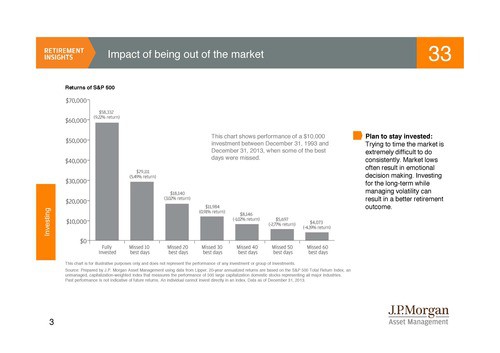

Trying to time the market can prove detrimental for optimizing your portfolio’s growth. Sherman Wealth Management’s skills will help guide you through volatility. An individually tailored portfolio will try to deliver comfort in downturns, and help you maximize potential benefit from the market’s gains. Contact Sherman Wealth Management now so your portfolio doesn’t miss any more opportunities to maximize potential returns.

Informative data at your fingertips.

Learn more about our Retirement Planning services.

Related Reading:

Four Things Entrepreneurs Can do Now to Save for Retirement

Finding Financial Independence

YOLO (You Only Live Once) so you Need a Retirement Goal

Your 401K Program: A Little Savings Now Goes a Long Way

How Much Money do you Need for Retirement These Days?

Advantages of Participating in Your Workplace Retirement Plan

LFS-929619-052014