Although planning for your future is always a necessity, many people tend to wait until they are older to put their legal documents in order in the event something should happen to them. However, the rapid spread of the coronavirus has led to a skyrocketing demand for wills, even for those who aren’t middle aged or older. What once appeared to be a scourge that was primarily affecting the elderly and those with underlying health issues has now been revealed to hospitalize and kill those who are younger, seemingly at an alarming rate. The search term “getting a will” has risen sharply since March 8 and there have been tweets from doctors and nurses in recent days about wanting to get advanced health-care directives—living wills, power of attorney for health-care decisions and do-not-resuscitate orders—because they know their work might expose them to the virus. Whether or not you are on the front lines of the fight against COVID-19, it is a good idea to make sure you have the following information completed and updated for you and your family should the need arise.

Wills & Beneficiaries

Now is a good time to check your existing beneficiary designations for each of your retirement accounts, annuities, and life insurance policies to make sure they are current and you do not have any lapses. In cases where family situations have changed, possibly because of divorce or birth of children or grandchildren, these designations aren’t often up to date. In the event you do not have a named beneficiary who survives you, your estate will be the beneficiary, which is rarely a good result. With a Will, you can generally leave any type of property to whomever you wish, with some exceptions. Wills can be contested in probate court, but beneficiary designations are legally binding.

Many people haven’t had an opportunity to change or update their beneficiaries since the SECURE Act was implemented. See (https://www.investopedia.com/what-is-secure-act-how-affect-retirement-4692743) to review how your retirement may be impacted by the SECURE Act).

Durable Power of Attorney

A durable power of attorney is a written document where you designate another person (agent) to act on your behalf. In the event you become physically or mentally incapacitated, it enables your agent to handle your affairs. A person’s ability to name a power of attorney normally terminates upon their incapacity. With an immediate durable power of attorney, you grant your agent the authority effective immediately.

Health Care Proxy

Also called a durable power of attorney for health care, this document appoints a representative to make medical decisions on your behalf. You decide what your representative will have control over (i.e., selection of health care providers, approval of tests and procedures, etc.). It is important to have an active health care proxy in place in the event you become incapacitated.

If you have adult children, you might want to make sure they also have health care proxies in place. In addition to having a health care proxy, a living will allows you to approve or decline certain types of medical care, such as life support, even if you will die as a result.

Trusts

If you have previously established a living or irrevocable trust, now is a good time to confirm that your trustees and successor trustees are still alive, willing to serve, and that you still want them to serve should the need arise. You should also confirm that all the assets you want to pass through your trust are correctly titled.

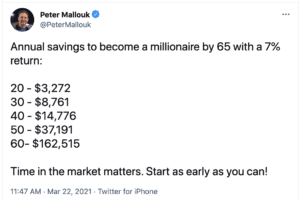

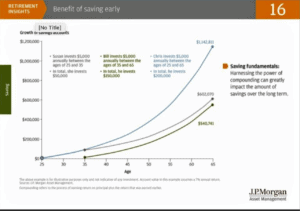

While the above topics are often difficult to think about, this also might be a good time to take a look at your financial plan as well. Depending on your circumstances, it might be beneficial to gift highly appreciated assets out of your estate at deep discounts. If you are in a low tax bracket, converting part or all of your Individual Retirement Account (IRA) to a Roth IRA could be an asset to your long-term retirement plans.

Should you need any referrals for an estate lawyer, we are happy to put you in touch with someone. If you have any financial questions, please contact us anytime. We hope you are staying safe and healthy – we are all in this together!