Do You Know What Interest Rates You Are Paying On Your Credit Cards?

As inflation continues to rise and be top of mind for the average household, we want to continue discussing how it is affecting our daily life and how to navigate this adjustment. Prices of nearly everything have been skyrocketing over the last few months, and the most recent November CPI report announced a 7.1% year over year increase. This year we have seen inflation levels the highest they’ve been in four decades, so it’s certainly making an impact on the wallets of individuals. In fact, according to Moody’s Analytics analysis, inflation is costing the average American household an additional $327 per month.

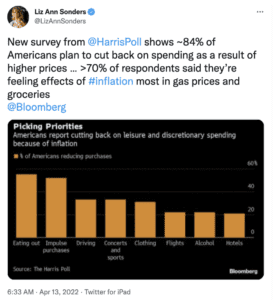

So, as Americans face new and higher costs that impact their monthly and yearly budget, it is likely many will begin to cut back on their typical spending habits. The following tweet from Liz Ann Sonders shows that ~84% of Americans are expecting to slash their spending to account for inflation. Have you adjusted your budget for inflation? Many retailers have been reporting surpluses of inventory and less holiday shopping as well, so if you have changed some aspects of your spending, you are certainly not alone.

While we are discussing the strains inflation is inflicting on the households of many, we want to touch on another interesting point that many individuals may overlook. Are you aware of the interest rates you are paying on your variable interest rate debt? With the Federal Reserve raising interest rates and set to announce their next hike this afternoon, it’s important that you know what the current rates are on your credit cards and lines of credit? So many individuals are carrying credit card debt and do not make it their number one priority to pay it down. According to Bankrate, on 12/07, variable credit interest rates were as high at 19.40%, which may only rise more as the Fed plans to continually hike rates in order to combat inflation.

If you are carrying credit card debt, make sure you are aware of the interest rates each of these debts incur. You should be attempting to pay your debt with the highest interest rates down first so that you aren’t continuing to pay an excess amount in interest each month. Start thinking more about the interest rates you are currently tied to and your finances as a whole. If you happen to carry a balance or want to protect against future rate increases if you have an unforeseen big purchase, take advantage of those 0% interest rate credit cards offers if you can. However, only spend what you can afford within your budget.’

Additionally, as we just saw November’s inflation data come in lighter than expected, maybe that’s a sign that the Fed’s hikes have been effective and future interest rate hikes may begin to slow, in which case you can re-evaluate your rates as they begin to go back down. So, an important lesson is to pay attention to what debt you have, the interest rates you are paying, and how the economy applies to your financial situation. Setting up a plan to pay off your debts in a timely manner will be extremely advantageous to you and your finances in the long run. If you would like to discuss budgeting strategies or have questions about your interest rates, email us at info@shermanwealth.com or schedule a complimentary intro call here.