How Will The Proposed Tax-Plan Affect You?

On Wednesday, the Trump Administration released their nine-page tax plan titled “United Framework for Fixing Our Broken Tax Code.” That’s a mouthful. The full text of the plan can be found here. So how will the proposed tax-plan affect you?

The reviews are in, and they suggest that while the plan is considered “finalized,” there is still a high level of uncertainty and vagueness in the plan that makes it difficult to assess how it would impact the average American.

Some have suggested that President Trump and the Big 6 (Gary Cohn, Steve Mnuchin, Mitch McConnell, Sen. Orrin Hatch, Paul Ryan and Rep. Kevin Brady) might not have learned as much as they could have from the failure to repeal and replace the Affordable Care Act, which arguably was defeated due to a lack of clear details and shortage of bipartisan support. In a repeat tactic, the push for passing the bill under “budget reconciliation” would require only a simple majority in the Senate to pass the law. But it should be noted that this can only happen if projections show that the total revenue differential over the next 10 years is $1.5 trillion or less. Right now, projections place it at $2.5 trillion over the next 10 years. That means the GOP will either need bipartisan Senate support with 60 votes or find $1 million in reduced projections.

Here are some of the highlights of the proposed plan and how they could impact your personal income taxes if they should be passed:

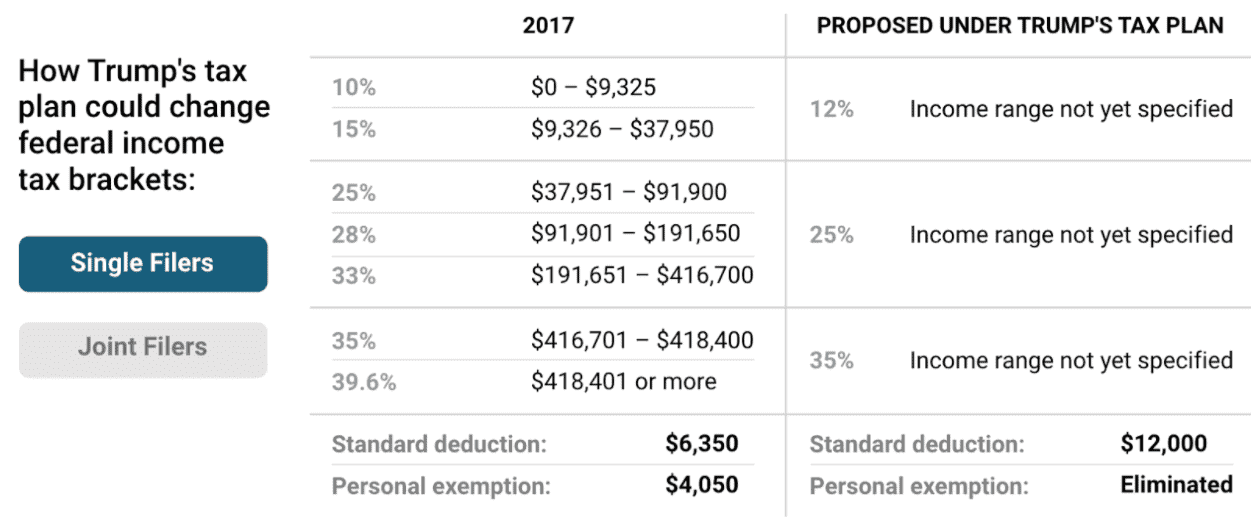

- Fewer Tax Brackets – Instead of the seven tax brackets we face today ranging from 10% to 39.6%, the new plan proposes only three: 12%, 25%, and 35%. Because the plan does not specify where these cut-offs will be, though, we can only speculate on how these will impact individuals positively or negatively. If speculation is correct, those currently facing 28% and 33% tax rates would see a tax cut to the new 25% rate, which would be beneficial. The idea of adding a fourth bracket for the wealthiest Americans has also been floated.

- Doubles the Standard Deduction, but Eliminates Personal Exemptions – The marketing tactic for the bill is that it is a huge break to middle-class Americans by doubling the standard deduction from $6,350 to $12,000 for single filers and from $12,000 to $24,000 for joint filers.

There is a catch, though. These increases are being offset by the elimination of personal exemptions. The result is what seems like a 50% increase to most taxpayers, in reality, is closer to 15%.

- Reduction of Elimination of Itemized Deductions – If in the past you have chosen to itemize your deductions, you could be getting the short end of the stick here. The plan calls for reductions or elimination of many itemized deductions, without providing specifics on which ones. It has only been stated that they will keep the deductions for home mortgage interest and charitable contributions. It also mentions benefits that encourage work, higher education and retirement savings, but provides no details on these.

The largest red flag for many is concerning the elimination of state and local tax deductions. Currently, you can deduct what you pay in state and local taxes from your federal income bill. If this is eliminated, it could disproportionately affect those who live in high-tax states such as Connecticut, New York, New Jersey, California, and Maryland. Only two days after the plan was released, objections from Blue-state Republicans have caused them to reconsider eliminating these deductions.

Additionally, homeowners or anyone paying real estate taxes will see that their property taxes are no longer deductible under the new plan. Again, this will have a disproportionately large impact for those living in states with high real estate taxes.

Below is a breakdown of what the new and old tax brackets could look like for single filers:

Source: Business Insider

Source: Business Insider - Changes for Families– There may be some significant changes to the tax code surrounding families as well, including single parents and households with two or more children.

Currently, single parents fall into a favorable tax bracket somewhere in between single and married-filing-joint rates as well as a 50% boost to their standard deduction. The new plan would likely eliminate this, meaning single parents could face higher rates.That being said, these cuts could potentially be offset by an unspecified “significant increase” to the Child Tax Credit. Depending on the size of this Child Tax Credit, households with a two or more children could also see increased rates because of the elimination of the exemption based on the number of children.

- Eliminates the Death Tax and Alternative Minimum Tax – The estate (“death”) tax only currently applies to 0.14% of Americans, whose assets exceeded $10.9 million and did not hire a competent estate planner. So this likely does not affect you, but it would be eliminated under this plan.

The alternative minimum tax forces those who have an outsized number of deductions to pay an alternative tax rate instead. The truth is, very few people understand it anyway. This is likely a good thing, especially if the goal is simplicity.

- Small Businesses, including ours! – In terms of small-business owners, there is a whole separate set of changes to be considered. For ‘pass-through’ businesses like ours, the plan wants to lower the maximum rate from 39.6% to 25%, which is particularly appealing to making smaller firms more competitive.

Questions still surround this due, though, to Steve Mnuchin’s vague statements regarding limitations on what types of businesses will get this lowered rate as well as how they will distinguish between personal income and business income. Additionally, many have pointed out that nine in 10 businesses that pass through their income already pay at the 25% rate or less, meaning this change could be ultimately inconsequential.

For larger corporations, the plan proposes lowering the tax rate from 35% to 20% and a one-time repatriation of overseas assets at an unspecified lower rate.

If you have any questions related to your specific situation, don’t hesitate to contact us here. We will keep you updated as more developments are made and the plan evolves.

***

The views expressed in this blog post are as of the date of the posting, and are subject to change based on market and other conditions. They are for information purposes only. This blog contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Please note that nothing in this blog post should be construed as an offer to sell or the solicitation of an offer to purchase an interest in any security or separate account. Nothing is intended to be, and you should not consider anything to be, investment, accounting, tax or legal advice. If you would like investment, accounting, tax or legal advice, you should consult with your own financial advisors, accountants, or attorneys regarding your individual circumstances and needs. No advice may be rendered by Sherman Wealth unless a client service agreement is in place.

If you have any questions regarding this Blog Post, please Contact Us.