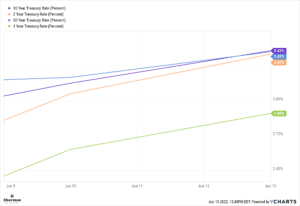

The Federal Reserve announced at its meeting today they are increasing its benchmark interest rate by 0.75%, the largest increase we have seen since 1994 in order to combat Friday’s 4-decade high inflation report. We saw rates rise over the last few days following the hot inflation report as you can see in the chart below. Fed Chairman Jerome Powell also said that he expects the Federal Reserve to hike rates by yet another 50 to 75 basis points during the July meeting and that “inflation can’t go down until it flattens out”. We will continue to monitor future rate hikes, but let’s take a look at how these increasing rates will impact the consumer.

We previously wrote a blog discussing how a rise in interest rates will affect your wallet and future financial situation. A great place to start during this uncertain environment is to make sure your financial plan is up to date. Make sure you know everything you have and aggregate your entire financial picture into one place.

While we don’t know exactly where the market and interest rates will go, with talks of a recession near, it’s important to revisit your cash flows, keep a comfortable emergency fund, and review your budget and goals. Next, take a look at the debt you currently have and think about how these rising rates may impact variable interest rate debt you may be carrying or will carry in the future. Additionally, remember the importance of time in the market over timing the market. Especially for you long-term investors out there, make sure you stick to your financial plan and don’t let panic derail your roadmap and financial portfolio. As we continue to watch interest rates rise, seek out high-yield bank accounts with the highest interest rates that you can take advantage of.

We know that the current market environment might have you questioning your finances and current financial plan, which is why we are here to help. For more information on how rising rates will impact your portfolio and financial life, email us at info@shermanwealth.com or schedule a complimentary meeting to discuss your personal financial situation here.