The Month Of July In The Markets

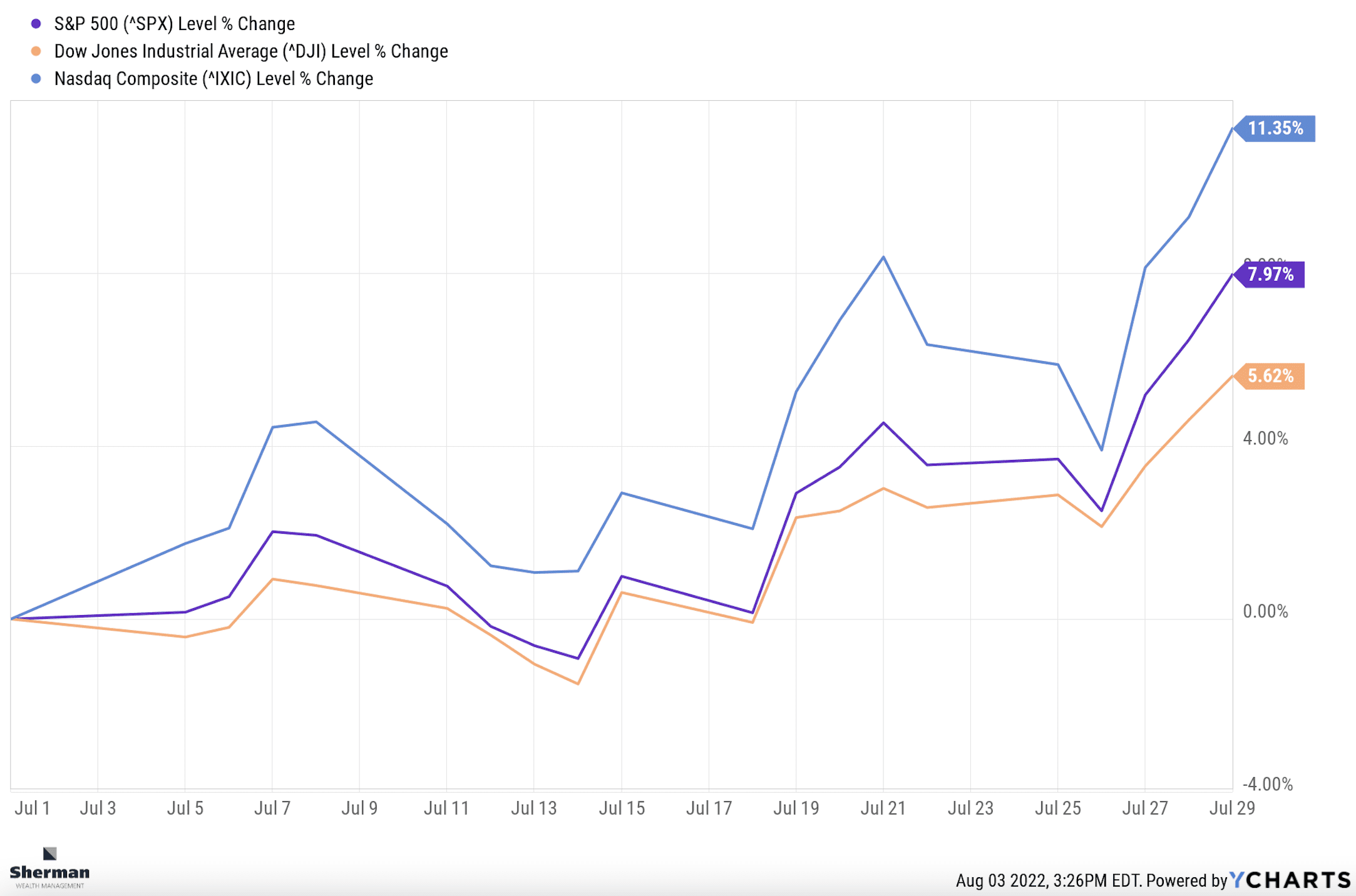

Happy August everybody-crazy summer is almost over! As we head into the last month of summer, we want to take a moment to review what a month July was in the markets. As you can see in the chart below, we had a good start after July 4th, then came down and rocketed higher. On the week of July 15, after we had the CPI inflation data announced hotter than expected at 9.1%, the markets fell for two days following that news, but since then we’re pretty much up in a straight line from there with the NASDAQ leading the way at 11.35% to mark its best month in two years. We also saw the S&P500 hitting almost 8% and the Dow at 5.6%.

A lot of folks, of course, are calling this a bear market rally or some type of relief rally. Even with July’s strong numbers we are still down significantly year to date marking the worst first six months of the year since the 1970s.

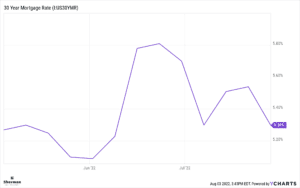

So will we see the rally continue into August? Or is this just a bear market rally? We will find out soon. A lot of what we found has been tied to interest rates. We see from this chart, mortgage rates completely rolling down to 5.3% as of last week, and the chart as high as 5.8%. Housing is obviously a huge part of the US economy, so many folks are worried about how this will impact their housing agendas, but we will continue to track it for you.

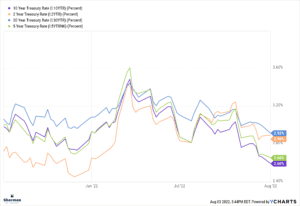

Additionally, we saw Treasury yields slip and as you can see from here, the yield curve is inverted. Remember that means that short term rates are higher than long term rates. So you see the 10-Year Treasury rate down to 2.6% fallen from a high of 3.5% in the middle of June when the market was really at its lows, so a real massive rally in both bond price and market price with almost a 100 basis point drop there from 3.5% to 2.6%.

So if you are in the market for a home, talk with your lender, see if you can get a lower rate. Of course, we’re also seeing people still in 0% interest rates on their FDIC insured savings at money center bank still earning zero, while we’re seeing high yield savings in the mid-1% range. And if you want to tie up the money for a bit longer, CDs are in the 2% to 3% range.

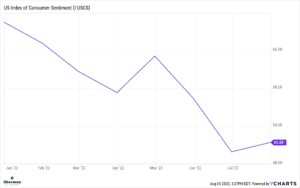

Next we want to talk about what we discussed in June, consumer sentiment, which is still close to all time lows, even though we saw a very, very slight uptick in the last reading. However, we want to hear from you- What are you feeling about the talks of a recession and such high inflation? We’ve heard that the Federal Reserve will be hiking rates once again in their next meeting in September and probably in October. What are you doing differently in this type of environment? Where did your consumer sentiment fall in July? Let us know at info@shermanwealth.com.