Launch Financial-A Glance Into Earnings Season And Coinbase IPO

Check out this episode!

Check out this episode!

As we kick off April and financial literacy month, we want to remind you about the tax deadline extension the IRS instated this year. Due to the coronavirus pandemic, the federal government extended this year’s federal income tax filing deadline from April 15, 2021, to May 17, 2021. This extension automatically applies to filing and…

On this week’s episode of Launch Financial, we are joined by special guest Dr. Josh Funk, Founder and CEO of Rehab 2 Perform. Throughout the episode, Josh shares his experiences creating and expanding his small business and how he has learned to adapt in an ever-changing landscape of the business world and COVID-19. A little…

Check out this episode!

Join us on this week’s episode of Launch Financial as we are joined by The Washingtonian Group’s Andres Serafini and Daniel Esteban. On this episode, Andres and Daniel will share tips on how to compete, plan, and protect yourself in such a hot real estate market. For more information on Andres and Daniel check out…

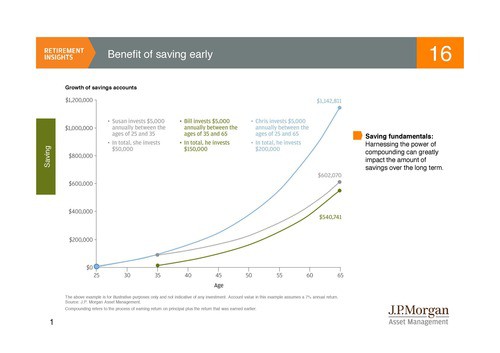

Combining asset allocation and early regular savings today helps to prevent playing the catch up game tomorrow. Contact Sherman Wealth Management for an investment strategy that, with periodic review, will potentially maximize your savings in the long-run with respect to your individual tolerance for risk. We can show you the benefit of saving early for…

Check out this episode!