Ep. 90 Launch Financial- Inflation’s Impact On The Consumer

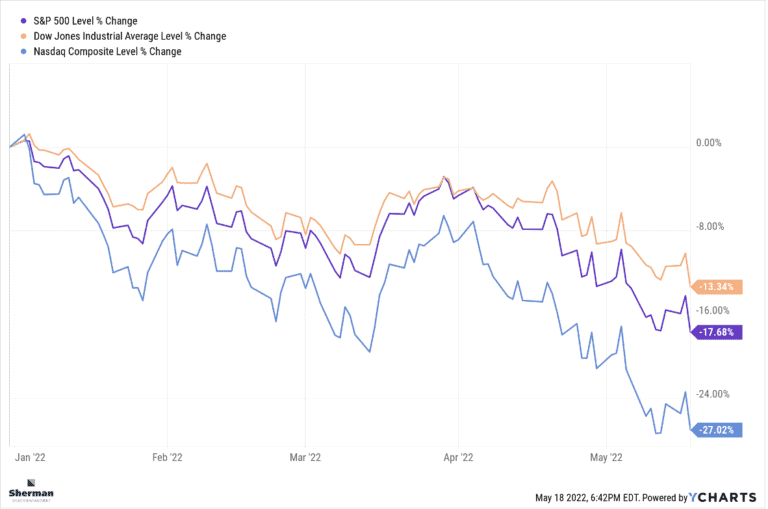

Overview: Happy Tuesday, we hope you had a wonderful holiday weekend. Join us this week on Launch Financial as we discuss the impact that inflationary prices are having on the average consumer and record high home sales. Show Notes: Check out this episode!