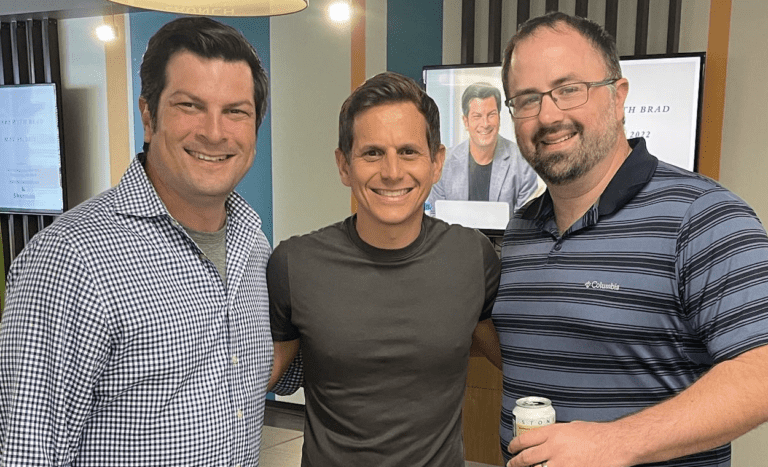

Brad Sherman Named To Investopedia’s 100 Top Financial Advisors of 2023 List

I am very honored to be named to the seventh annual Investopedia 100 list of most influential financial advisors of 2023 for the fifth year in a row! The seventh annual Investopedia 100 awards program recognizes financial advisors who demonstrate an industry-leading ability to reach large and diverse audiences, and use their influence to foster financial…