What Should You Do in a Market Sell-off? Rule #1: Don’t Panic

Whenever there’s a crisis, it’s good to have an emergency plan, and when there’s a financial crisis, it’s good to have a financial emergency plan. When you’ve thought through a plan, it’s less likely that panic – or other “behavioral mistakes” – will lead you to react in ways you may be regretting for a long time.

While most investors say they’ll continue to hold on to their investments when there’s a sharp downturn (and many even say that they’ll add money when their investments go down), data tells a far different story. In December 2008, right as the market was near its lowest point, investors pulled out a whopping $10.6 billion from equity mutual funds alone.

Panicking during market bottoms is a form of “behavioral bias” that can have a devastating effect on financial health. While the S&P 500 has averaged around 10% a year, costly behavioral mistakes cause many individual investors to significantly miss those gains. That’s because, despite good advice, people still tend to put money in the stock market as it rises and pull money out as the market falls. The result: many investors buy at market tops and sell at market bottoms.

While none of us are immune to behavioral biases, there are several things we can do to help avoid costly mistakes.

1. Learn From the Past

The first step is to understand that market declines are a normal part of investing and resist the urge to panic!

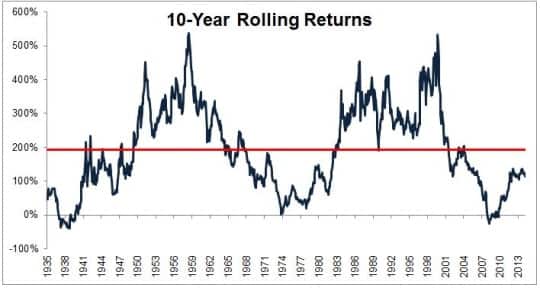

While the S&P has historically returned almost 10% annually since the 1960s, those returns are not consistent. One year the market could be up 20% and the next it could decline 12%! To make the ride even bumpier: the market also has streaks where returns decline for several consecutive years. That’s when investors often begin to panic and pull their money out. Unfortunately, that’s usually the worst time to do so, and when investors often should be increasing their investments instead.

Although the market can move up and down in the course of a year, or several years, it has historically trended upwards over longer periods of time (10 or 20 years.) So if your investment horizon is longer than just a few years, remember that it’s likely the market will recover its losses – and then some – over time.

Understanding that the U.S. stock market bounces back after its declines is a helpful first step in creating “un-biased” financial habits!

2. Understand that Accepting Lower Returns May be Okay

Generally speaking, younger investors have more years ahead of them to invest. That means they are often able to put a higher percentage of their money in stocks and a very low, or even zero, percentage in bonds. How much you allocate to stocks will depend on factors such as your own investment objectives and your ability to tolerate risk.

If you know that you’re prone to panicking during market declines, however, you may want to keep your portfolio in more conservative investments than your age and investment horizon would normally indicate.

It’s much better to be a bit more conservative and hold on to your investments during market downturns, than to buy riskier assets and sell during market crashes!

3. Speak with a Professional

If you’re like most Americans, chances are you spend more time researching your next car than researching your investments!

Investing can be a difficult – and sometimes dry – subject. Learning about the history of the stock market, your own risk tolerance, and behavioral biases that can trip you up is challenging for most people and probably something you don’t want to spend a lot of time on.

That’s where a trusted financial planner can help.

A good financial planner can help guide you along the path in planning for your own financial goals; explain difficult concepts; help you discover your own risk tolerance; recommend appropriate investments based on those risk tolerances; and help you avoid making the behavioral mistakes that ruin so many people’s portfolios.

A good financial planner also understands the history of the market and knows that, while bull markets don’t last forever, declines are generally temporary as well. Knowing that, and having a plan tailored to your specific financial goals will help you to avoid panicking when markets go south, and avoid making the behavioral mistakes that ruin so many people’s portfolios.

Brad Sherman is a financial advisor based in Gaithersburg Maryland who is experienced in understanding both the history of the market, as well as how behavioral biases affect investor returns. He has a Masters in Quantitative Finance from American University and over a decade’s worth of experience in the financial industry.

If you think it may make sense for you to hire a financial advisor, call him today to see if you are a good fit.

LFS-1151185-031715