March Madness and Investing: Surprising Similarities (And How to Avoid Common Mistakes)

What a great time of the year. Cherry blossoms are out, baseball opening day is right around the corner, and the best single elimination tournament in sports is on its way. That’s right, it’s March Madness time.

For those of you unfamiliar, March Madness, as it’s commonly called, is a 64-team college basketball single elimination tournament. There are four regions that each have 16 teams seeded 1 though 16. The winners of each region meet in the “final four” to determine who will emerge as the champion.

Offices around the country are buzzing with brackets, upset picks and friendly wagers. In other words, it’s chaos both on and off the court and it’s glorious!

In case you couldn’t tell, I love sports. As a financial advisor, I am constantly looking at seemingly unrelated topics, and comparing them to the world of finance. What may come as a surprise to you is that investing and March Madness have more in common than you think.

So what does the tournament have to do with investing? Let’s have some fun and take a look.

You Can’t Predict the Future

Every year people get excited about their bracket. We watch the “experts” on TV and eagerly listen to their reasons for picking one team over another. We all go into the season thinking that this is “our year.” We’ve done the research and we’ve studied history. What could possibly go wrong?

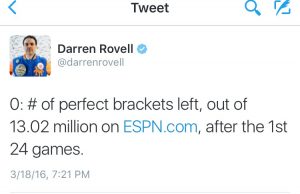

In the first round of this year’s tournament, a record 10 double-digit seeds advanced to the second round! Do you think a lot of people predicted that? Not a chance.

Have you ever heard the saying on Wall Street that past performance does not guarantee future performance? There’s a reason the saying exists. Just like last year’s successful mutual fund managers aren’t any more likely to pick this year’s best accounts, the winner of last year’s bracket pool is no more likely than you to pick this year’s winning March Madness team.

Have you ever heard the saying on Wall Street that past performance does not guarantee future performance? There’s a reason the saying exists. Just like last year’s successful mutual fund managers aren’t any more likely to pick this year’s best accounts, the winner of last year’s bracket pool is no more likely than you to pick this year’s winning March Madness team.

When it comes to investing, “experts” love to tell us what is going to happen in the future. People brag about their best stock picks and conveniently leave out their poor ones. The truth is, no one knows what is coming. Once you accept that, you can create a financial plan that takes into account your risk tolerance, and current life situation to make the best investment decisions for you.

Diversification and Risk vs. Reward

No one picks a perfect bracket. The odds of filling out a perfect bracket are 1 in 9.2 quintillion (source: USA Today). According to that number, if everyone in the US filled out one bracket each year, we would see a perfect bracket once every 400 years. You’d be better off gambling with the lottery based on those odds.

However, straying from the standard “favorites” isn’t always the answer either. People love to pick the underdog or “dark horse,” but if you do this consistently year after year, you aren’t likely to have much success. That doesn’t mean you can’t pick an underdog here or there, but the risky picks should be a subset of your overall picks, not the full strategy.

The truth is, no one wins a bracket pool by picking all favorites or all upsets. As the point above taught us, everyone is just guessing. By diversifying your picks with some favorites and some upsets, you give yourself the best chance at success.

The same principal applies with investing. If your portfolio is composed of stocks from one sector or all growth stocks, you are exposing yourself to huge amounts of risk. Sure, the reward may be great if you end up being right, but as we’ve seen time and time again, that is a strategy that can set you up for disaster.

***