Money in Cash? Make Sure you’re Getting the Best Rate

While the stock market has been steadily climbing for the past few years, a surprising number of people are keeping a surprising amount of money in cash. And while everyone is going to have a certain amount of cash allocation, what’s even more surprising is how many people are losing out on maximizing the interest rates for those assets.

Advisors typically recommend holding 3%-5% of your assets in cash – for emergencies, short term savings goals, a new home or a vacation, or simply as a hedge against volatility. Yet, according to the latest Capgemini World Wealth Report, high-net-worth Americans are currently holding more than 23% of their assets in cash.

Why would investors prefer cash over a booming stock market? Studies, like this one, have shown that “cash on hand” – the balance of one’s checking and savings accounts – is a better predictor of happiness and life satisfaction than income or investments. Put simply, people like having “money in the bank.”

There’s no reason for that “money in the bank” to be earning zero though, particularly when there are many FDIC-insured, highly-rated, savings account options that may be yielding a higher interest rate on your savings than your current bank or investment firm’s savings options.

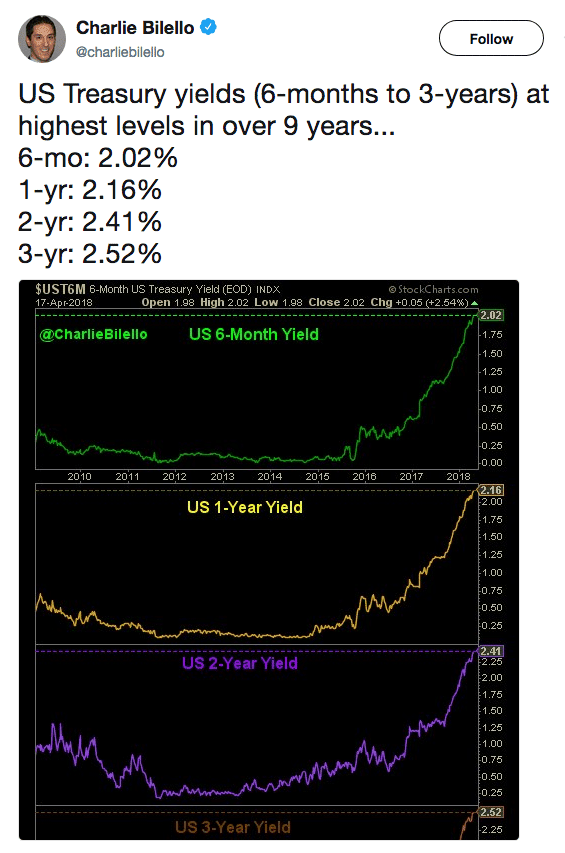

Short terms saving rates generally follow moves by the Federal Reserve and, as indicated by the chart to the right, short term interest rates, as reflected in short term Treasury yields, are rising. But is your bank raising your interest rates too or are they pocketing the difference and profiting? While the percentages seem small, there is actually a significant difference between earning .05% and 1.5%: the difference between earning $5 and $150 on a $10,000 savings account.

Put simply, if your cash is in a zero percent interest account, it’s no better than putting it under your mattress. You’re losing money, both in lost interest and because inflation can reduce the value of your savings.

Do you know if your own savings account’s interest is keeping pace with rising interest rates? If not, check with your advisor to make sure you are maximizing your money’s earning power. If you’re not, consider shopping for a higher rate. Cash should be an asset class, but it shouldn’t earn zero.

If you’re not sure, we’re always available for a free consultation to see if you’re getting the best rates and you’re maximizing the earning power of your cash reserves.