We know many of you have been anticipating the Fed Meeting that occurred earlier this week. What you may be wondering now is how the hike in interest rates will affect your wallet and your future financial situation. Check out the transcription from our Fed Meeting episode of Launch Financial below or listen here!

Brad: Good afternoon and welcome to a Federal Reserve Meeting special episode of Launch Financial, joined, as always, by Ashley. Ashley, how’s it going?

Ashley: Not much everything’s going well, we’ve got some big news to talk about.

Brad: Big news. First Federal Reserve rate hike since 2018, way before you were following economic policy, I’m sure, but hard to believe it was that long ago. Folks are not used to a rising interest rate environment, as the American consumer and markets have been kind of conditioned to a falling interest rate economy since 2018, as we mentioned.

Brad: Obviously, we know we had emergency said cuts during COVID. We want to talk about what it means for the markets, the economy and of course, your wallet, how it impacts you, the consumer and investor. Fed Chair Jerome Powell, speaking now with the 10-year treasury yield at 2.2%, which is the highest since about 2019.

Brad: We just want to unpack what that means. So those of you with credit card debt, you should see an even greater interest rate increase, we’ve talked about this for quite some time. So if there’s a zero percent offer on your credit card and you have a balance or if you’re thinking about making a big purchase, grab those zero percent interest rate credit cards while they’re still out there.

Brad: Now Auto loans. A lot of folks are having an issue buying a car, as we’ve talked about for some time. We do think that this will impact your auto loan, so we don’t know what the direct impact to the consumer will be, but figure about a quarter of a percent as the Federal Reserve continues to raise rates. In fact, they are talking about doing seven rate hikes throughout the course of the year. So this is more of a preparation now. If you haven’t been preparing since we talked about this a couple of months ago, the Federal Reserve has telegraphed this move and it shouldn’t be that much of a surprise. I think it’s more of a surprise that they want to do seven more this year to get it to about 1.8 percent.

Brad: So for mortgages, we saw the average 30 year fixed mortgage rate move a full percent since November. That’s a dramatic move. The market’s been digesting this news for quite some time, so that’s something that if you haven’t refinanced or you’re still in the market for a home, make sure you’re double checking with your lender to see what impact this will have on your purchasing ability and your monthly payments.

Brad: Next up we have student loans that might be tied to LIBOR or T-bills. Of course, most student loans are at a fixed rate, so anything with a fixed rate, of course, won’t be impacted. And then, of course, we have home equity lines of credit. A lot of people have been tapping into their homes to do projects and other things. Remember that those are directly tied to the prime rate. So, at your next statement, you will see an impact there of your prime plus a certain adjustment. That means that your interest rate just went up by 0.25 percent or 25 basis points, as it’s been indicated in the news, so lots to unpack here. We will continue to follow all these moves for you, as we always do. Ash, anything you want to add in this emergency press conference?

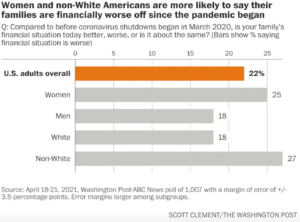

Ashley: Yeah, I think it’s just important to keep an eye out for these different things you mentioned above. We also saw that jobs and wages might be impacted as well as we have been in a fast wage growth environment with a lot of job openings. So people are saying that might change as well. Also, it is important to note that savings accounts will be impacted as well with higher interest rates, so keep an eye out for all of this and let us know if you have any questions or thoughts.

Brad: Great. And we’re also watching the yield curve, an indicator of future recessions, which is flattening out. We will be following all these things and more, let us know as Ashley said, if you have any questions that may directly impact you and your money.

If you have any further questions about the impacts of the Fed raising interest rates, email us at info@shermanwealth.com or schedule a complimentary 30-minute meeting here.