Behavioral Investing: Men are from Mars and Women are from Venus!

While no person falls neatly into statistical averages, as humans, we are all emotional beings and subject to all different kinds of behavioral biases when it comes to investing. There are three major ways in which men and women differ when it comes to behavioral investing.

Investment Goals and Strategies: According to the Wall Street Journal, finance professors Brad Barber and Terrance Odean, women tend to focus more on longer-term, non-monetary goals. Women generally associate money with security, independence and the quality of their life and their families’ lives. Women have a ‘safety first’ mentality. Generally speaking, women are more inclined than men to wear seat belts, avoid cigarette smoking, floss and brush their teeth and make regular doctor visits. They even have been shown to be 40% less prone than men to run yellow traffic lights. Men, on the other hand, who tend to be more competitive and thrill-seeking by nature, often focus on the short-term track records of their portfolios, incurring larger overall returns, and tend to be more risk tolerant. In contrast, women tend to be more averse to risk and are more skeptical. When it comes to investing and planning for their future, women shy away from uncertainty and will take a longer time to make investment decisions, are more methodical in how they go about research, and ask more questions.

Both men and women should make sure that their investment styles and horizons match their overall financial goals. For women, this may mean taking on more risk. As they become more familiar and understand the ups and down of the stock market they will naturally become more risk tolerant. For men, this may mean focusing more on longer-horizon goals, rather than on short-term trading track records and larger gains.

Prudential’s study Financial Experience & Behaviors Among Women

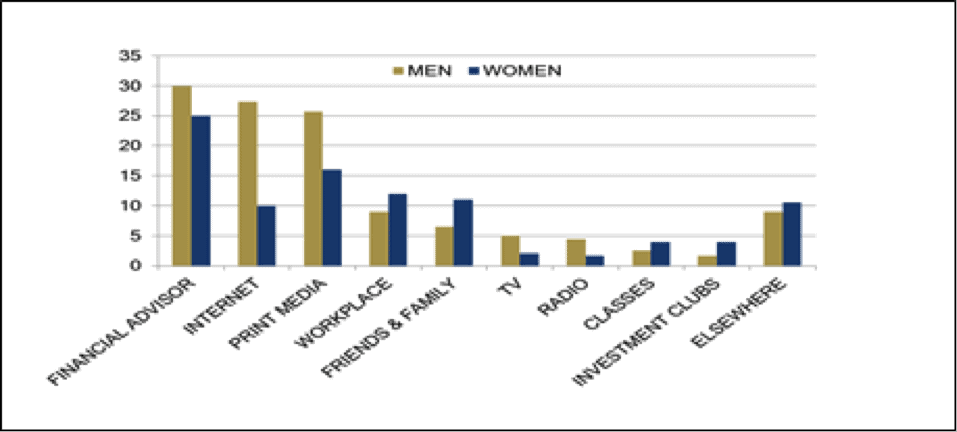

The Learning Curve: A 2012-2013 Prudential study on women investors reveals that women are more receptive to financial research and advice than men. Women seek help more often. Men tend to enjoy learning on their own and take a more independent approach, like the internet, while women prefer learning in a group setting. Women rely more on personal networks with friends, family, financial planners, and they take a networking approach to gathering information. They often require more of a financial advisor’s time and resources, but are looking for a trusted relationship to be established, one they can rely on long term. Men, however, prefer to teach themselves and are more self-directed learners, using the Internet (more often than women) to gather information and are more likely to claim they understand financial matters than women. In actuality, knowledge levels are not high for either gender.

Thus far, evidence does not support, however, whether one source of information or learning technique is more or less effective than another.

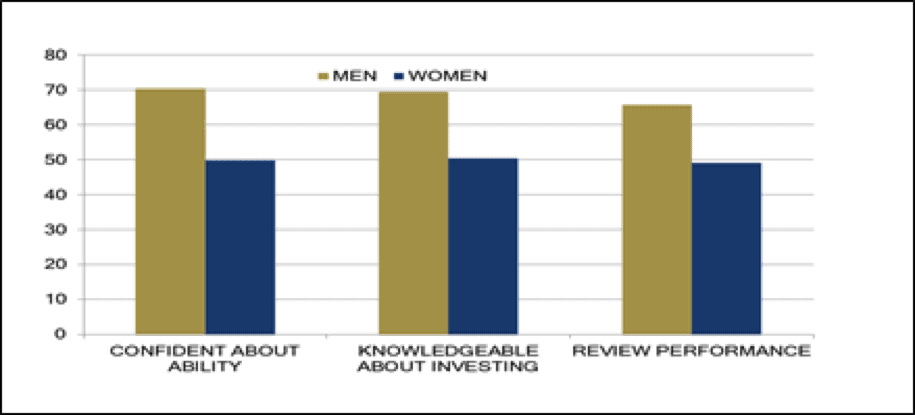

The Confidence Factor: Women tend to be thorough and take more time to make decisions than men. Several studies, including a national survey by LPL Financial, show that women tend to research investments in depth before making portfolio decisions, and the process, as a result, tends to take more time. Women also tend to be more patient as investors and consult their advisors before adjusting their portfolio positioning, whereas men are more prone to market timing impulses. Men veer toward overconfidence while women lean towards indecisiveness and insecurity.

Overconfidence can lead to taking too much risk. While women risk missing out on some investment opportunities in taking more time to make decisions, men’s generally higher impatience when it comes to seeing investment returns makes them more likely to attempt market timing, and prone to loss when the timing is off. Women are less afflicted than men by overconfidence, or the delusion that they know more than they really do and are more likely (than men) to attribute success to factors outside themselves, like luck or fate.

Yet, taking too little risk, due to lack of confidence, can hurt your investment goals just as much as overconfidence. When it comes to investing for the long term, taking risk is not a luxury. Insecure investors can confine their results by investing too conservatively, nearly as much as their overeager counterparts could do by excessive trading and risk-taking.

Meanwhile, to help avoid rash decisions and market impulses, men may benefit from implementing a systematic investment strategy and a periodic, rather than continuous, review of their accounts and rebalancing. They may want to consider becoming even more open to professional financial advice. Women may also want to review the efficiency of their investment allocations across their portfolios to counter the negative impact of mental accounting. In addition, they may want to consider attending financial education seminars to help boost their confidence levels and ability to make timely, well-informed investment decisions.

Call Brad Sherman at Sherman Wealth Management for information on what investment strategy is right for you.

Learn more about our Investment Management services.

Related Reading:

Tips for Millennials to Understanding the Stock Market

What is Dollar Cost Averaging?

5 Big Picture Things Many Investors Don’t Do

Why and How to Get Started Investing Today

Mitigating Your Investment Volatility

The Psychology of Investing

Rebalance Your Portfolio to Stay on Track With Investments

LFS-981494-080414