How The Secure 2.0 Act Might Impact You!

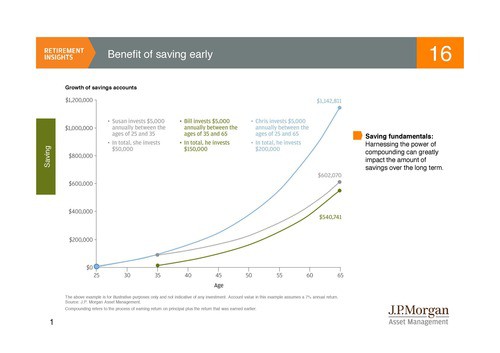

Happy New Year everyone, we hope you had a wonderful holiday season and wish you a healthy, happy, and prosperous New Year. Before the start of 2023, on December 29th, Congress passed the Secure 2.0 Act that was promised to provide changes to help many Americans’ retirement plans, including over 90 updated retirement plan provisions….