Here’s How Bitcoin Will Affect Your Taxes

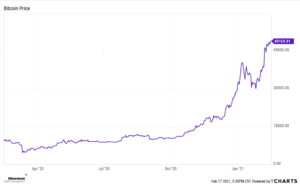

Getting swept up in the crypto-currency craze? Thought so. Since the coronavirus pandemic took its toll on the world in March, bitcoin has rocketed towards the sky. Hovering at approximately $5,000 in March, bitcoin broke its record high at $50,000 this week as you can see in the chart below.

With the increase of interest in meme stocks and crypto-currency in recent months, we want to bring light a facet of these stocks that you may not be thinking about. With tax season beginning as discussed in our previous blog, you should take a second to look at the tax implications involved with bitcoin and meme stocks. If you are to get swept up in day trading on Robinhood or other platforms, you should know the difference between short and long term tax rates. It’s important to note that some of these alternative coins cannot convert to cash, which could cause some complications when it comes to your taxes.

No matter what asset class you are investing in, keep in mind that it’s either most tax efficient in a retirement account or to hold onto for more than a year. If you are day trading or thinking for the short term, be very aware of the tax implications and how that affects the overall return of said investment. If you do not plan on selling your investments or are thinking about selling, it is important to understand these tax implications as well. As always, make sure you understand the risks involved before investing and only risk what you can afford to lose. When listening to the media and the Dave Portnoy’s of the world, it’s easy to swept up in the hype; however, these influencers do not usually discuss the serious tax surprises that these investments can have. Sherman Wealth is charitably inclined, and if you are as well you might want to consider setting up a donor advised fund or donating your gains right to charity if you are sitting on gains before selling.

While it may be exhilarating and increasingly popular to get involved with meme and heavily shorted stocks, keep in mind the complications and volatility involved. At Sherman Wealth, we always encourage you to keep a diversified portfolio that will benefit your financial future and goes along with your individual risk tolerance and financial plan. If you have any questions about anything discussed in this blog or need help finding the right tax professional to help you with your tax return or discuss donating assets to charity, please reach out to us at info@shermanwealth.com or schedule a 30-minute consultation here.