Millennials – Time to Wake Up and Smell the Stock Market

On Monday, as things were heating up a bit, Cullen Roche tweeted “The stock market is the only market where things go on sale and all the customers run out of the store…”

The problem is, many Millennials weren’t even in the store.

Only 26 percent of people under age 30 own stocks, according to a CNBC story that same day. That means that, while not panicking, most Millennials may have been missing one of the biggest potential opportunities of the past 10 years.

Why Aren’t Millennials Investing?

There are many theories –from Millennials being shell-shocked by experiencing their families’ anxiety in 2008, to YOLO, the feeling that it’s better to spend and enjoy the money now because who knows what the future may bring. The problem is that the future is likely to bring a whole lot fewer opportunities if you haven’t planned properly!

Are You Even Beating Inflation?

Let’s say hypothetically that the stock market may rebound by 5%… Simple, common sense math shows that keeping your money in the bank at .05% interest means it would take you 100 years to make the same amount of money that investing it now could. And the cash you are saving under the mattress or in one of your vintage vinyl sleeves? That money is just losing value every second you leave it there, as the cost of blankets and concert tickets continues to climb with inflation.

Risk, Volatility, and Paper Losses

It’s important to know the difference between risk and volatility and many people get it wrong.

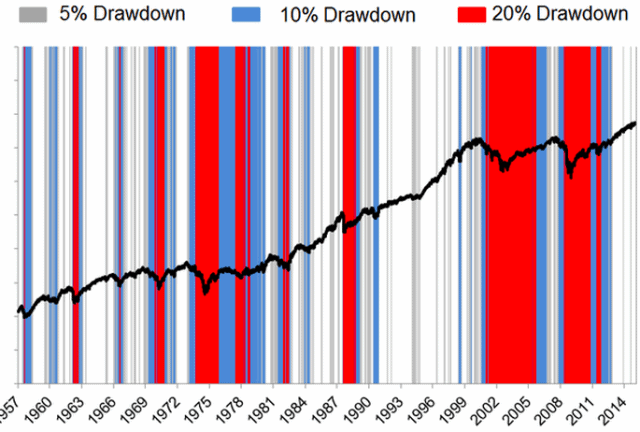

Volatility – stock prices moving up and down – is a normal part of the stock market and an opportunity for a disciplined saver to buy when the market is both up and down. When you have a solid plan in place you can capitalize on market price dislocations, like what happened this week. Risk is how likely you are to lose it all and it’s important to remember – while everyone has their own risk tolerance – price corrections and market volatility does not necessarily mean you are going to lose it all. As the chart below borrowed from The Irrelevant Investor’s excellent post on staying the course shows, the stock market has historically climbed in spite of dips. And paper losses are just that: it’s not real loss if you don’t sell.

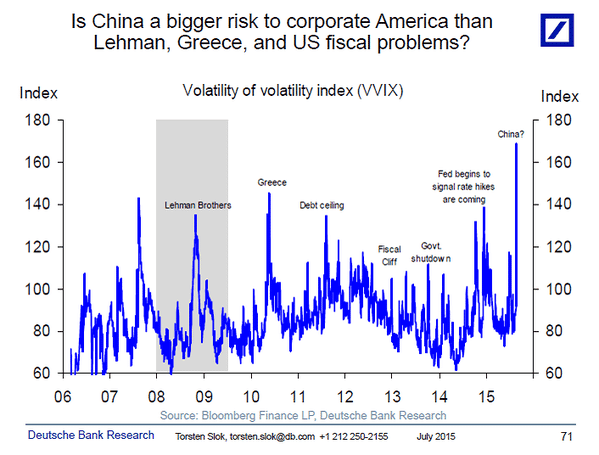

As this chart by Deutsche Bank’s Torsten Slok shows, in spite of other times of great volatility, markets have always recovered. It’s just a question of timing.

Millennials: This is Your Wake-up Call

When I speak to fellow Millennials, they say that the real reasons they don’t invest are that 1) it’s daunting to get started and 2) they don’t know where to get help. The big companies aren’t interested in smaller investors with less than 250-500K and the robo solutions don’t understand what makes each smaller investor’s situation unique. There’s a whole new breed of financial advisors, however, who combine personalized service with targeted tech solutions for smaller investors. So no excuses – there are financial pros ready help you create an investment strategy that makes sense for your personal goals and financial situation. And volatility doesn’t disrupt what we do!

The Bottom Line

If you’ve got a solid financial plan, investing in the stock market does not affect your ability to pay your rent, take care of yourself or your family, or add to that rainy day emergency fund. The money you’re saving and investing is money that you’ve determined you don’t need now, it’s money you have set aside for the long haul. Assuming your planner has planned correctly, you’re not going to miss your car payment because the Chinese stock market is crashing.

And that huge correction that scared you in 2008? It eventually rebounded and the market continued to climb. As a Millennial you’ve got years on your side if you start investing now. And you’re losing the potential for growth and compounded interest every moment you wait.

Baron Rothschild, of the Rothschild banking family, is credited with saying “The time to buy is when there’s blood in the streets.”

Look around. If you’re not investing yet, this might just be the time to start.

LFS-1283981-082715

2 Comments