The Problem with “Buy Low, Sell High” Advice

Of the many common sayings in the finance industry, the most popular is undoubtedly “buy low and sell high.” While it sounds simple enough, it’s actually significantly more complex than it seems.

Not Following the Herd

Buying low comes from an investment philosophy known as value investing. The basic concept of value investing is to buy investment instruments when they are “on sale.” That means buying when everyone else is selling (and prices are down) and vice versa. A bargain-hunting value investor looks for what they consider to be healthy companies that are – for whatever reason – severely undervalued. A smart value investor buys low, then patiently waits for the “herd” to catch up. Unfortunately, most investors tend to do the exact opposite. We tend to chase trends and follow the herd. (For more, see: Don’t Let Emotions Hinder Your Investing Goals.)

Sounds Easy. So Why is it Hard?

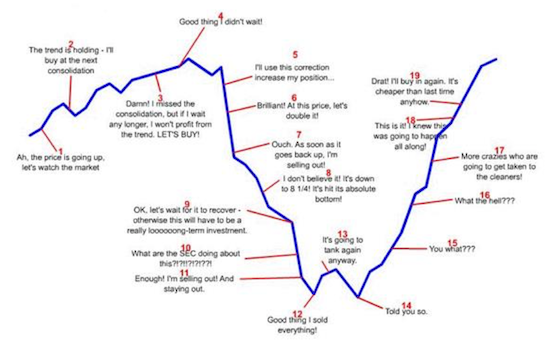

A huge part of smart investing is psychological and this chart illustrates of one of the many psychological roadblocks we have as investors.

We may want to buy low and sell high, but that goes against our instincts and biases. When a stock is falling, we dump it. When a stock is rising, we buy it. We sell a company when the price is falling because we are afraid of losing more money; we buy a stock when it is rising because we have a fear of missing out. To compound the problem, most investors are not experts at realizing when something high or low “enough.”

At times, investing can feel like quicksand: the more you do and the harder you try, the more you sink. It requires effort to overcome the psychological biases that often prevent us from acting in our own best interest. It is human nature, for instance, to continue to make the same mistake over and over again, or to not let go of stocks when we should through either familiarity bias or disposition effect.

Goals and Risk Tolerance

So what can you do to avoid to avoid the pitfalls of trying to buy low and sell high?

- Understand your goals and risk tolerance: before you get started investing, it is critically important to understand what it is you are trying to accomplish and how much risk you are comfortable taking. Once you have that figured out, you can create an investment plan that is appropriate for you and comfortable enough to keep you from impulse buying high and panic selling low.

- Avoid market timing: instead of trying to time investments perfectly and squeeze every last cent out of each one, focus on building a diversified portfolio of stocks and bonds that give you the greatest chance to succeed over the long term.

- Leverage your resources: having a great financial plan and a diversified portfolio is irrelevant if you don’t follow through and stick to it. Becoming self-aware of the pitfalls is a great first step. Having a good financial advisor is a good step too. Just make sure that they are a fee-only fiduciary, so that they have your best interests in mind at all times.

Think about it: if it were easy – if everyone bought low and sold high – there would be no high or low because the market prices would be continually correcting. Bargains do exist and sometimes the wisest choice is to lock in earnings. The safest financial plan for the long run, however, is to understand your goals and risk tolerance, then work to create an investment plan that builds on gains over the long term, rather than continually outguess the market.

(For more, see: Which Investor Personality Best Describes You?)

This article was originally published on Investopedia.com

***