Sign of the Times

Sign of the Times

It wasn’t too long ago that every teenager was fawning over the boy-band One Direction. Now, only a few years later, the band members are all pursuing their own solo careers. In his 2017 solo debut album, the former One Direction member Harry Styles sings the hook “Just stop your crying, it’s a sign of the times.” While there are numerous interpretations of what the line is about, when I hear it my mind wanders immediately to investing.

Maybe that makes me a finance nerd, but I connect these two because the world of investing is changing so rapidly, and that isn’t necessarily a bad thing. It used to be that mutual funds were the be-all and end-all of getting exposure to diversified equity and fixed income returns. Modern trends, though, show that millennial investors are increasingly enamored by exchange-traded funds (ETFs) and are pouring more money in these diversified low-cost, passively managed index funds than ever before. A recent article reported that 66% of millennials say they expect to boost their holdings of ETFs over the next year, up from 61% in last year’s survey.

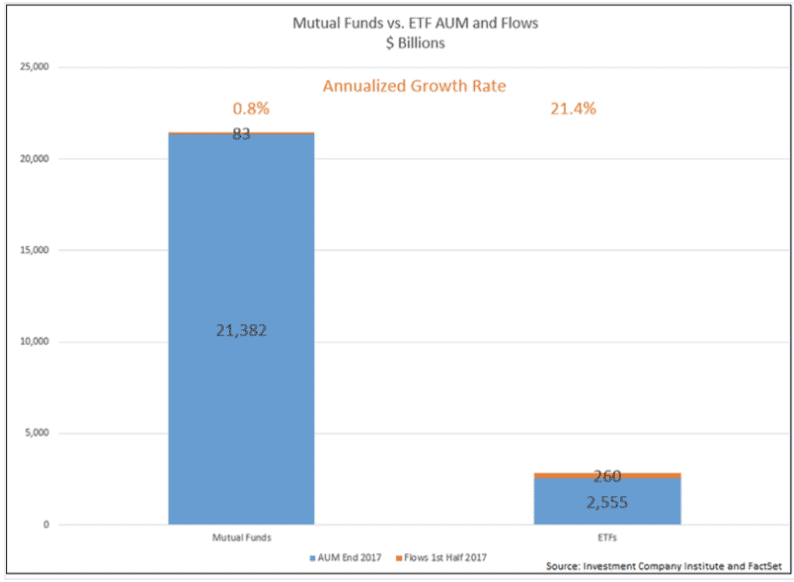

You can see a similar growth trend in the chart below. We can see that while asset levels for actively managed mutual funds are still eight times higher than ETF asset levels, there is a staggering difference in their annualized growth rates. While mutual funds are barely growing at .8%, ETF assets are growing at a pace of 21.4%.

The conclusion is clear: ETFs took in more than three times the net inflows in the first half of 2017 because the world is changing. Millennials are seeking out the funds as an alternative to traditional mutual funds in response to the changing environment around them, the preference for low-fees, and the flexibility of being able to trade in and out of the funds as frequently and as quickly as they desire. The faster that advisors start to recognize and adapt to that changing world, the better they are able to meet the needs and desires of their clients.

At Sherman Wealth Management, we understand that our clients are seeking low-cost, diversified portfolios and as a fiduciary, we feel it is our responsibility to take advantage of the opportunities posed by ETFs. We were one of the early adopters of these diversified funds because we saw the value of having a low-cost, tax-efficient portfolio that, if done wisely, can be combined to meet target allocations that have diversification benefits creating worthwhile risk-adjusted returns.

We see ETFs as an opportunity instead of competition. Instead of individual stock picking, ETFs give us the ability to spend our time focusing on a top-down approach to asset allocation. This means assessing where the opportunities lie within different asset classes and combining attractive ETFs in these high-probability sandboxes in a way that we feel will maximize risk-adjusted returns. Instead of the cookie-cutter allocation achieved by working with robo-advisors, we have real people putting together your portfolio and looking under the hood of these funds to ensure that they are the best pick for you.

At Sherman Wealth Management, we want to be ahead of the times – not stuck lamenting the past.

So… just stop your crying, it’s a sign of the times.

**