Straight Talk about Volatility and Compound Interest – the Snowball Effect

Compound interest is, simply put, the interest you earn on the sum of both your initial investment and the interest that investment has already earned.

Why is it important? Because your two potential advantages when it comes to maximizing potential earnings over time are:

- The power of compound interest

- Investing regularly through market highs and lows

Let’s break this dynamic duo down:

The Power of Compounding

Compound interest is often compared to a snowball. If a 2-inch snowball starts rolling, it picks up more snow, enough to cover its tiny circumference. As it keeps rolling, its surface grows, so it picks up more snow with each revolution.

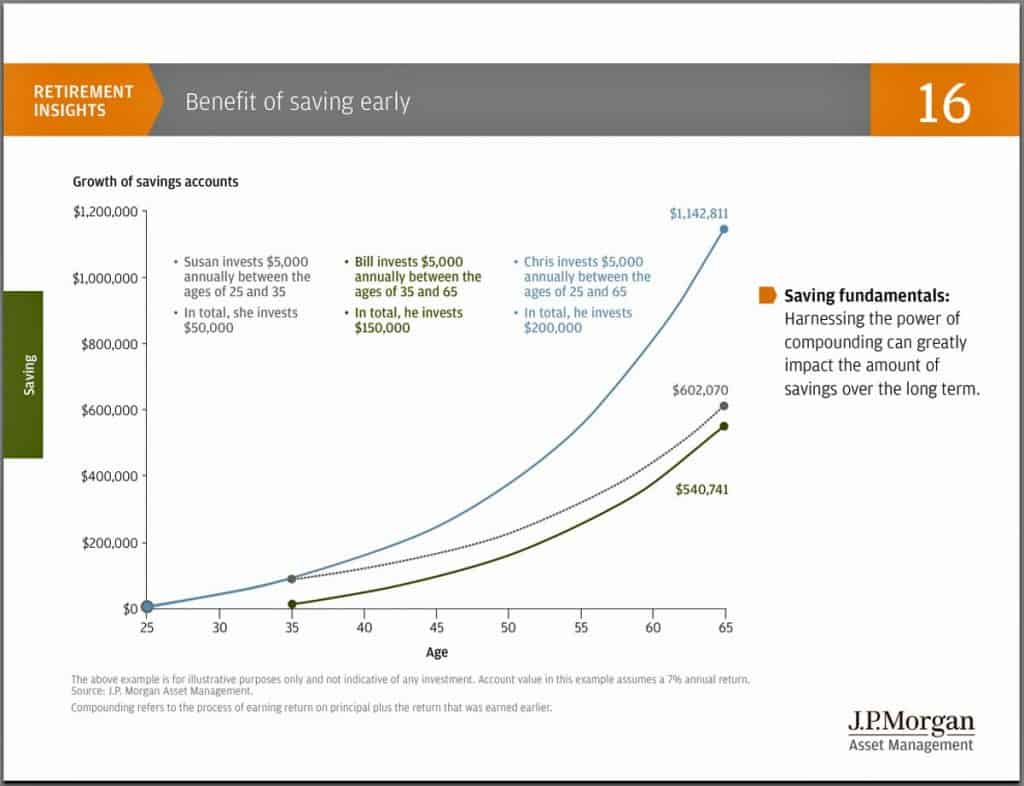

If you invest $1000 in a fund that pays 8% annual interest compounded yearly, in 10 years you’ll have $2158.93, in 20 years that will be $4660.96, in 30 years it will be $10,062.66, and in 40 years it will be $21,724.52. All it takes is patience to turn $1000 – the price of one ski weekend – into $21,724.52.

That’s why it’s so important to start saving early.

The above chart is hypothetical and assumes an 8% rate of return compounded annually. It is for illustrative purposes only and is not indicative of the performance of any specific investment. Investment return and principal values will fluctuate so that your investment when redeemed may be worth more or less than its original cost. Rates of return do not include fees and charges, which are inherent to other investment products. Past performance is no guarantee of future results.

Volatility – Market Highs and Lows

But what happens if the market dips and your investment loses value?

Volatility – when market value fluctuates up and down – can be an opportunity for disciplined savers who contribute regularly to their investments, regardless of share price. When prices are low, you’re able to buy more shares. When prices are high you’re able to buy fewer shares for the same amount but those shares earn more interest, which is called Dollar Cost Averaging (Dollar cost averaging does not protect against a loss in declining markets. Since such a plan involves continuous investments in securities regardless of the fluctuating price levels, the investor should consider his or her financial ability to continue such purchases through period of low price levels.)

Imagine that snowball again, rolling down a hill, acquiring more and more snow as it goes. What happens when it hits a bare patch with no snow? Often it picks up rocks and pebbles, which add even more surface volume. So, when it hits the snow again, it picks up even more because it’s larger.

That’s how compound interest, coupled with regular investments, may work too: the “rough patches” produce more volume, which then allows you to acquire more compounded interest. So if you buy more shares during a dip, when the market recovers you could hypothetically not only earn compound interest on more shares, you earn more interest. So long as the price of your particular investment recovers, of course.

As Josh Brown points out in his recent blog post about Warren Buffett and David Tepper, both these legendary investors have gotten to where they are today because they’ve successfully ridden out volatility. In 1998 Warren Buffets own Berkshire Hathaway’s “A” shares had dropped in price from approximately $80,000 to $59,000 but Buffet didn’t sell. Those shares just hit a high of $229,000 this year.

If you see volatility – like what we experienced in August – as a tool and keep contributing regularly to your investments, you’ll potentially maximize the effect of compounded interest and watch your investments snowball over time!

LFS-1174145-041515

******

Additional Reading:

http://awealthofcommonsense.com/did-investors-just-experience-the-best-risk-adjusted-returns-ever/

http://www.bls.gov/data/inflation_calculator.htm

http://www.moneychimp.com/features/market_cagr.htm

http://investor.gov/tools/calculators/compound-interest-calculator

5 Comments