Weekly Market Review 1/4/2019

Staying in theme, it was another wild week for stocks. Investors, who are probably over the volatility from 2018, were unfortunately required to sit through a couple more brutal sessions on Wednesday and Thursday, as the Dow Jones Industrial Average notched its worst start a year since 2000. However, following a reassuring tone from Fed Chairman Jerome Powell on Friday, large indices will actually finish the week in positive territory.

Earlier this week, President Trump seemingly doubled down on his willingness to let the government shutdown continue. The President is staying solid on his refusal to sign any funding bill that does not include $5 billion for a wall on the U.S.-Mexico border. Democrats remain insistent they will not provide the votes to give him that funding as the shutdown now stands at fourteen days.

Much of the worry in stocks began on Wednesday, when Apple had its worst day in 5 years, moving down almost 10% at one point. The company slashed its quarterly revenue outlook (almost a month before it’s scheduled earnings report), blaming its lowered projections on soft iPhone sales in Asia, with CEO Tim Cook publicly attributing some of the weakness to U.S.-China trade tensions.

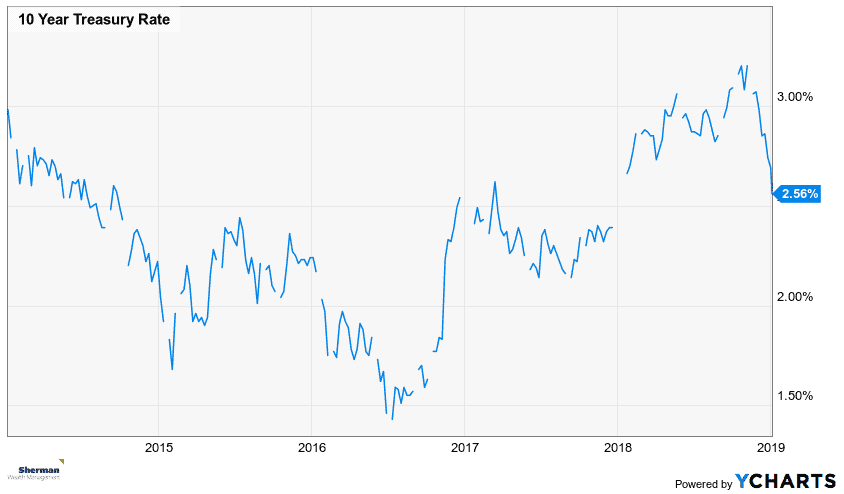

Financial markets have been in turmoil over the past several months, in part over concern whether the Fed was being too aggressive in its stance on hiking rates. In fact, Chairman Powell himself has helped to fuel some of that speculation. On Friday, Powell did offer remarks to show that Fed policy will take into account economic conditions and be adjusted accordingly. Powell also noted that the economy still looks quite strong.

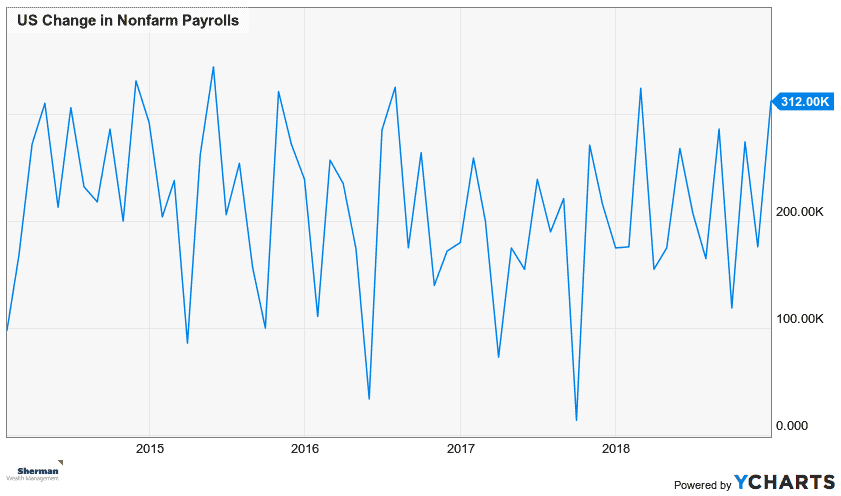

According to the data release this week, U.S. employers added 312,000 new jobs last month, nearly double the Street consensus of 177,000. Average hourly wages also rose, to an annual rate of 3.2%, while the headline unemployment rate bumped higher, to 3.9%. The strong December jobs report is a net positive for stocks because investors’ biggest concern has been slowing growth. On top of this, recent data shows that 2018 saw the most manufacturing job growth since 1988, with a net 264,000 jobs added over the previous twelve months.

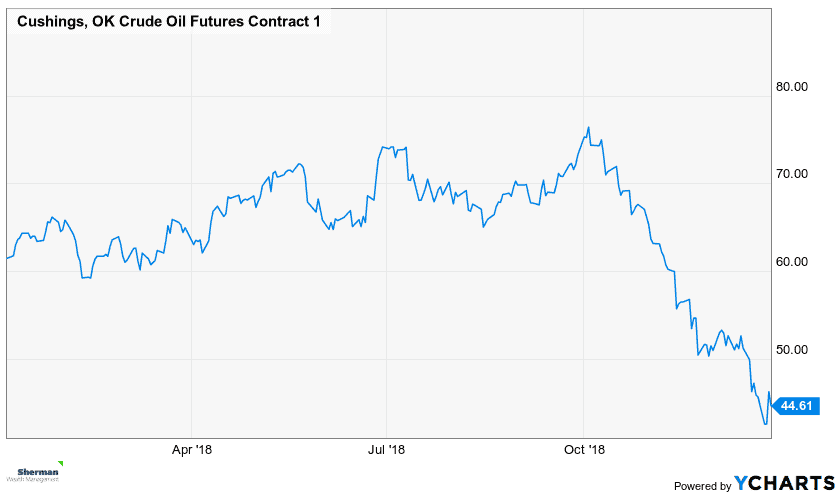

Oil futures had their first weekly gain in a month, as the previously mentioned (and positive) economic data boosted the outlook for global growth in general. Prices also climbed Thursday as separate surveys showed December crude output from major producers saw their biggest monthly declines since January 2017.

Oil futures had their first weekly gain in a month, as the previously mentioned (and positive) economic data boosted the outlook for global growth in general. Prices also climbed Thursday as separate surveys showed December crude output from major producers saw their biggest monthly declines since January 2017.

U.S. retail sales were up 5.1% last year to reach than $850 billion, according to a Mastercard report that looks at consumer purchases from December 1 through 24. It was the strongest performance in six years. The National Retail Federation had projected that consumers, on average, planned to spend $1,007 for decorations, candy, gifts, and other purchases for themselves. It was also a great year for online retail, with sales jumping 19.1% over 2017 according to the same study. Apparel sales were up 7.9% year over year as well, showing the best growth since 2010.

Are you aware of what you’re paying in fees? Is your portfolio truly in line with your risk profile? You’d be surprised at the number of people who have never asked their advisor these questions. If you’d like to explore further, please feel free to schedule a meeting by clicking here!