Why It’s A Good Time For Roth Conversions

Given all the recent economic data and the current market downturn, you may be thinking about moves you should be making within your investment portfolio. While it’s important to revisit your asset allocation, risk tolerance, and time horizon during such a time, considering a Roth conversion is also a great idea. So let’s take a look at what a Roth conversion involves and why an economic downturn presents a good opportunity to do one.

A Roth conversion is when you convert money from a traditional retirement account such as a Traditional IRA or Traditional 401(k) into a Roth vehicle. As mentioned in previous blogs, a Roth vehicle is an account where you pay taxes on the money before entering the account, allowing you to withdraw tax-free monies in the future. So, if you do decide to do a Roth Conversion, you would have to pay taxes on the pre-tax money you are converting, allowing tax-free withdrawals in the future.

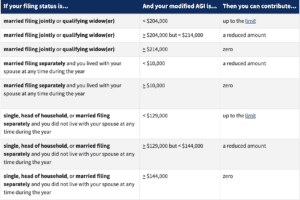

So, why is now a good time for a Roth conversion? Well, given the current market downturn, a Roth conversion is a great idea because since your account value is probably currently lower than previously, a conversion will allow you to capture the values and convert the same amount of shares at a lesser value, ultimately paying less money in taxes on your next tax return. If your overall compensation and income is currently lower possibly due to equity compensation or you are a retiree awaiting social security, a Roth conversion might be a great opportunity for you. Click here to see the 2022 Roth income limits and thresholds from the IRS and see if you qualify to participate.

All individuals we work with have different financial situations, which is why it is a great time to connect with a financial professional and/or CPA to see what options you may have to take advantage of during this time. We have been doing conversions with a great deal of clients during this extreme market downturn and are happy to help you as well. If you want to learn more about your ability to utilize a Roth conversion, email us at info@shermanwealth.com or schedule a complimentary 30-minute consultation here.