Why It’s Prudent To Invest With A Long-Term Mindset

Given the rollercoaster of volatility we’ve seen in the stock and bond markets over the last few years, we want to see how are you feeling as it relates to your investments and overall financial stability? As we near the end of the second quarter of 2023, it’s important to reflect on your emotions during the volatility and economic uncertainty we’ve faced and create a plan moving forward. We know last year was a hard year for many, watching their hard-earned savings and investments plunge up and down; however, as we see time and time again, the market does correct itself, so we are here to discuss the long-term nature of investing and the importance of looking at the bigger picture.

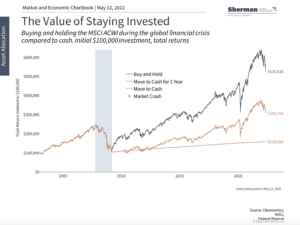

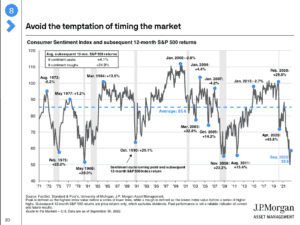

As you can see in the charts below, it is quite valuable to stay invested in the stock market for the long term, despite market crashes and corrections. We know that headlines in the news and day-to-day fluctuations can be scary and induce anxiety, but keep in mind your initial goals for investing and your time horizon. Many individuals try timing the markets, and we’ve actually seen many since the COVID-19 crash until now pull in and out of the market; however time in the market many times proves more prudent. If you are a long-term investor, try not to get too caught up in the day-to-day volatility, and rather the bigger picture and longer timeline. Although we do not know the direction the stock market will take in the future, as the chart depicts, time in the market instead of trying to time the market seems to be the better choice.

Another point to keep in mind is your risk tolerance and asset allocation. For those of you who have been feeling stressed or worried about your investment portfolio, now is a prudent time to meet with a financial professional to discuss your risk tolerance, asset allocation, and specific finances. It could be true that your asset allocation is not properly aligned with your risk tolerance, exposing your investments to either too much or too little risk. When you start thinking about investing, you also want to take a look at your short-and long-term goals so that you are making a decision on behalf of your larger financial picture.

We always recommend a mid-year financial check-up, so now is a great time to think about your emotions towards your investments and alter any parts that need change. It is also important to keep in mind that your investments are only a piece of your entire financial picture, so it’s a good idea to make sure your whole portfolio is well diversified and right for you. If you have any questions for us, we are here to help in any way we can. To reach our team, email us at info@shermanwealth.com or schedule a complimentary 30-minute consultation here.