Why Utilize a Financial Advisor?

Personal finance. Don’t underestimate the adjective.

In today’s world, the rise of “robo advisors” have led some to (incorrectly) conclude that managing investment portfolios is simple. As far as they are concerned, as long as you have a software program, you’re set. Within minutes, a computer system can analyze your risk tolerance, determine the best investments for your unique situation and be setup to adjust it every three months if it falls out of line. These programs provide low cost access to data-driven algorithms for trading. We’ve discussed some of the pros and cons in our recent blog post.

But there is something missing if that is where the finance conversation stopped.

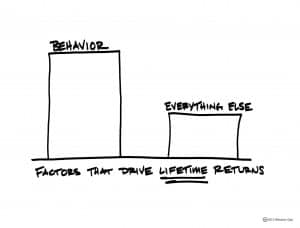

A glance at the Behavior Gap chart below points out the simple but incredibly valuable missing link: your lifetime returns are driven much more substantially by your own behavior than by the portfolio you have set up. This is where the financial advisor steps in, because managing you and crafting plans around your individual needs, behaviors, and ideas is something a computer program cannot do.

There are entire books written about the human psychology of investing and how, if left unchecked, it can negatively impact returns. In fact, the field of behavioral finance seeks to identify common biases that humans make when investing, including but not limited to: herd mentality, loss aversion, confirmation bias, availability bias, the disposition effect, familiarity bias and self attribution bias. These are just some of the many important behavioral issues that the human connection you have with an advisor can help you avoid.

A computer program cannot tell you that you are overreacting to a report you read on the news, or explain that chasing returns is likely not going to provide a benefit. A computer program can’t coach you through identifying personal goals or customize budgets that will grow and change as unexpected life events pop-up. A computer program isn’t going to give you a call when they see a red-flag in your budget or spending habits. A computer program can’t push you to think beyond a limited scope to identify all of your goals and priorities or be there to answer the phone when you have a question. For example: Do you want to send your kids to private school? Do you want to be there to support your parents as they age?

Don’t get us wrong: that hardly means you should shun technology. At Sherman Wealth Management, we believe that a good financial advisor knows how to take the power that technology has to offer and add in all of the benefits that only a personal human connection can provide. We believe that a good financial advisor is someone that you know and trust, who takes your financial plan as seriously as they would their own. Here, we utilize a user-tech interface that allows our clients to manage all of the pieces of their financial plan, from cash flow to 401Ks, while allowing an experienced advisor to monitor it for new opportunities and to ensure clients are on the path to meet their goals. That means you get access to all of their knowledge and expertise in combination with the power of technology to enhance returns, increase efficiency and provide you with flexibility and control. As a fee-only fiduciary, we take that responsibility very seriously, and that includes taking advantage of all of the tools at our disposal.

Do you feel that you are getting what you need out of your advisory relationship? If not, we encourage you to reach out to us at anytime here. Sherman Wealth Management’s approach is based on the understanding that personal finance should be just that… personal.

***