Curious about the recent tax proposal and how it may affect you? If so, check out our recent podcast or the transcript below as we were joined by special guest Shawn Donovan for a second time to discuss the fine print of the recent proposed tax plan. Shawn Donovan is a CPA and Partner at Turner, Leins, & Gold, LLC.

Shawn is a Partner in the firm’s Maryland office. He has more than 15 years of public accounting experience as a trusted business advisor for his clients. He is experienced in tax preparation, planning and consulting for high net-worth individuals, partnerships and corporations. Specifically he enjoys working with real estate developers, commercial real estate investors, other professional service firms and government contractors. Shawn also has experience in auditing and attestation for small and medium-sized businesses.

—

Brad Sherman: Good morning, and welcome to a special edition of Launch [00:00:30] Financial. Ash’s going to take a backseat today, but we are joined again by Shawn Donovan. Shawn, as you know from our early May episode, gave us wonderful primer on the proposed tax changes that the Biden administration had been going over. And, last week right before the September 15th quarterly deadline, they dropped this bomb through the House Ways and Means Committee on some proposed taxes. [00:01:00] And we wanted to bring back Shawn. For those of you who didn’t hear the first episode, go back and take a listen. Shawn joins us today to talk about some of the proposed changes. Shawn, welcome to the show. Welcome back. Great to see you and have you on. What’s new with the Committee?

Shawn Donovan: Good morning, Brad. Great to be back. Now we have some more specific clarity on some things that we thought may happen from the Biden proposal when he was running for President. Now we’re getting some [00:01:30] more clarity and more specifics about what’s going to be changing.

Brad Sherman: Great. For those small group that don’t know who you are, why don’t you tell everyone a little bit about yourself, and about the firm and whom you represent?

Shawn Donovan: Right. I’m a partner at one of the CPA firms here in Rockville. It’s Turner, Leins, & Gold. We have a Virginia office and a Maryland office. We handle high net worth individuals, small, medium sized businesses, and [00:02:00] we’re pretty much a full service CPA firm.

Brad Sherman: Great, great. A lot of things to unpack for high net worth individuals, as well as the small to medium sized business owners that we both collectively serve. In full disclosure, Shawn is the accountant to our firm and is a trust advisor, and wanted to make sure that he could share his guidance and wisdom with the audience.

[00:02:30] Where would you like to start? I know we talked before we recorded about some highlights for the two of us. Why don’t you start first with something that sticks out at you for folks to be thinking about in this new tax proposal?

Shawn Donovan: I think the thing that’s been really the headliner, the one everyone’s been concerned about is the capital gains rates increasing. When Biden was running for office, he’d initially said he wanted to raise it up to 39.6% from where it currently is, if you know, 15 to 20%. 20% if you’re [00:03:00] a high net worth individual making over $430,000 a year. Now, it’s going to be 25% for those households, 400,000 single, 450 married. It’s not quite the huge increase we were expecting. The one key point I noticed was there’s possible transitional rules effective September 13th, 2021. So, there might not be anything you can do about the capital gain at this point if they go back retroactively [00:03:30] to September 13th. We’ll just keep an eye on that one going forward. Hopefully, they allow all of 2021 to be under the old rules, but, we’re kind of at the mercy of their decision with regards to that.

Brad Sherman: Yeah. September 13th, I saw Twitter was exploding with highlighted numbers of the bill itself. September 13th was when this came out, so I guess pros and cons to everything. The pro is that it’s not retroactive to January [00:04:00] 1st of 2021.

Shawn Donovan: Yeah.

Brad Sherman: So, if you did have a capital gain event before September 13th, I guess you’re okay. From a planning perspective, really hard if you were in the middle of a transaction. Again, this is just a proposal, hard to believe that it’s going to pass as it stands. But it could, and definitely something to be mindful of after September 13th capital gain.

Shawn Donovan: Absolutely.

Brad Sherman: If you’re in the middle of a transaction [00:04:30] or wanting to sell some appreciated stock, not anything to plan for at least in the current bill as it’s written. But, definitely not fully retroactive to 2021, which there was rumblings of as well.

You brought up an interesting point. I think the definition that we talked about as we’ve had some clients who live in big cities and the definition of high net worth seems to be changing under this administration. I think one of the [00:05:00] big numbers that we’re seeing is $400,000 for single, 450 married filing jointly, which is a much lower number than the world was utilizing under the 2018 and prior.

Looking at these proposed income tax, capital gains 25% over 400,000. That’s basically a 10% reduction in income from the initial higher [00:05:30] end of the bracket, which as Shawn mentioned was 20, plus of course the Obamacare surcharge. And married filing jointly goes down another 10%, from 501 to about 450 there. Those are the new numbers of high net worth, which I know that some folks would argue can’t really get you much in high rent in high cost areas of living, such as the DC Metro area and New [00:06:00] York and California, and of course other major metropolitan areas where we’re seeing incomes a little bit higher than that.

Shawn Donovan: It’s for sure going to be an increase for people making in between that 400 to $600,000 married filing joint range. You were basically at different levels of 32 to 35 to 37%. Now once you hit 450 married filing joint, it’s [00:06:30] going to be 39.6% for couples making over 450,000, 400,000 for single. That could be a potentially big tax burden for those people, especially your friends in New York and around this area, the DMV. It’s going to be quite a headache for some tax payers for sure, when you look at the 2021 rates versus what it’s going to be going forward, if this bill passes.

Brad Sherman: Yeah, another thing that was really surprising to me and serving the [00:07:00] entrepreneurial community also, without making this a political discussion, but it seemed like a lot of the lobbies for Biden were Silicon Valley. One of the things that stuck out at me was the qualified small business stock. Maybe you can go through that for folks, slowly, who don’t know what that is, who may be small business owners or thinking of that as something to consider.

Shawn Donovan: Yeah, there’s a code section 1202 that basically will allow [00:07:30] you to invest in smaller corporations, startups and whatnot. And you get to, based on when you had your investment, you can exclude upwards of 75% to even 100% of your gains on the sale once you actually get out of that company, sell your stock, everything like that.

Now what they’re proposing is, any taxpayer whose AGI exceeds 400,000, or if you are a trust or an estate, you [00:08:00] no longer get that exclusion anymore. I don’t know what that’ll do to the startup industry to investments in these smaller companies, knowing that the investor is going to have to have a tax bill afterwards, once they sell their shares.

Brad Sherman: Yeah. Something definitely to consider. A lot of folks are using this small business stock as ways to plan for not only estate planning purposes, tax planning. To get that deduction, especially [00:08:30] on the sale, is a big deal. I don’t know, maybe the Biden administration wants everyone to push to W-2.

Shawn Donovan: Right.

Brad Sherman: We’ll see what happens and how it comes out, but definitely a shot in the foot for people who want to start something, and some of the incentives from a tax perspective to grow an entrepreneurial organization. So, definitely keeping that in mind.

One of the things that’s of interest that we do around this time [00:09:00] of year of course, is Roth conversions. The internet kind of got lit on fire with Peter Thiel’s $5 billion Roth IRA from the donating of the original, I guess, the PayPal seed shares that grew and grew within the Roth. And it looks like legislative powers that be are really coming after some of these loopholes, or whatever you want to call them, backdoor [00:09:30] Roths funding the IRA account, then converting it immediately. Looks like they’re really trying to tackle that, eliminate that. I saw, it was interesting that prohibits Roth convergence for the highest income bracket starting in 2032.

Shawn Donovan: Right.

Brad Sherman: So, have some time to plan for that.

Shawn Donovan: Right.

Brad Sherman: But then, also eliminate back door Roth as a planning strategy, at least in this proposal, [00:10:00] starting Jan 1, 2022.

Shawn Donovan: That’s going to be a big deal to some people, for sure.

Brad Sherman: Urge people as always to take a look at, especially if you’re in that real sweet spot between retirement and claiming Social Security where your marginal bracket rate might be lower from when you were working. So, if you have lower wages due to either a partial year retirement or something else, and you need to fill those [00:10:30] brackets up like we’re talking about, Roth conversions have always been a great strategy for those who are in a lower bracket. But, I think the next three months are going to be full of Roth conversions and people really taking a look at their effective tax rates now, if this bill passes, and what their effective tax rates will be in the future. If you want to speak about some of those changes that you might have seen.

Shawn Donovan: Yeah, for sure. The Roth conversion’s going to be a great [00:11:00] tool for 2021. Especially if you’re in between that 400 and $630,000 married filing joint, adjusted gross income range, you’re going to be paying 32% to 37% in 2021. Whereas next year, it could be 39.6, or in the future it could be even higher. We don’t know that. Plus, it reduces your future minimum distributions going forward, [00:11:30] required minimum distributions from your IRA. There’s a lot of good to doing Roth conversions.

Last year it was really good because of the removal of the requirement to withdraw from IRA. So, you could almost convert that Roth to replace the income and keep your income smooth throughout from ’19 to ’20. I would again consider doing it for 2021, for sure. As long as you can keep yourself in between the 32 and 37%, even if you’re at 37%, it might be worth considering [00:12:00] for 2021.

Brad Sherman: Yeah, definitely something to think about for those listening to reach out to your financial advisor or tax professional. Take a look at what your effective tax rate was on your 2020 return. Of course, as Shawn’s mentioning, just to go through, required minimum distributions did change from 70 1/2 to 72. Some folks that are in that retirement age, [00:12:30] that may not have an income distribution from their IRA, might be wanting to take advantage of a conversion. As Shawn says, it does reduce the amount that is required to be taken out. You do pay tax today, so definitely can model out the benefits to that on a case-by-case basis. But, if we are looking at higher tax rates in the future, this could be a huge planning opportunity for a lot of reasons.

[00:13:00] Going back to the Peter Thiel example, they really did come after it hard. It looks like within this bill, eliminating the ability to put company stock and some other things within the IRA, which is an interesting little caveat that I know a lot of folks were potentially buying other things, real estate, some other non-traded instruments within your IRA.

That’s another shot at this. It says, [00:13:30] according to this bill, “Prohibits IRAs from investing in entities in which the owner has a substantial interest, 50% ownership threshold for public companies, 10% for privately held.” We’ll see how that impacts IRA and retirement plans as well.

Shawn Donovan: The corporate tax rate, that has been a big one in the news that you’ve been hearing about. In 2017, it was reduced from 35% to 21%. That [00:14:00] was a pretty big decrease. I know the Democrats were not a huge fan of that big of an increase for huge C corporations that pay their own taxes. They’re coming up with now 26.5%, which is down from Biden’s original proposal of 28%. Sounds like a compromise was made somewhere. So, 26.5% is the corporate tax rate we’re looking at. It would still be the third highest I believe in the whole world, but much less than it was before at 35% pre- [00:14:30] Trump tax cuts. It’s a little bit of an increase. Not sure how it’ll affect clients of our realm where they’re smaller. You could still use planning to make sure the corporation doesn’t pay any tax at the end of the year by calculating year end bonuses, et cetera. That’s just another thing to keep in mind of the corporate tax rate, it will probably be increasing from 21%.

Brad Sherman: Got it. Definitely something to really [00:15:00] take a look at there. Just another opportunity to talk about the child tax credit. We’ve been back and forth on that. As some of you know, checks were sent out at some folks that were taking the child tax credit as a deduction on their returns. Just in this new bill, they’ve extended the child tax credit, but also want to make people aware that if you are getting the check and depositing it, you might be in for quite a surprise.

Shawn Donovan: Right.

Brad Sherman: [00:15:30] Because that money was previously being deducted off of your return. If you’re doing that, kind of be mindful.

Shawn Donovan: For sure.

Shawn Donovan: It was increased a little bit. It went from 2,000 to 3,000, so it won’t be such a huge hit for some. And I know it’s 3,600 for if you have kids under five, so it’s a little bit of a age difference, at five at the end of the year. If your kid turns six, like mine does at the end of December, 2021, you don’t get the 3,600. You [00:16:00] will probably lose a little bit of your credit on your return for 2021, but you’re getting the money up front. So, just keep in mind that your tax bill might be a little bit higher by the time you file 2021. You probably want to reach out to your CPA just to figure out how much higher.

Brad Sherman: Great tip there. For those crypto folks, the IRS has added also wash sale rules. Not fair that the equity markets are wash sale and then the crypto folks [00:16:30] could do what they want. It looks like some tightening there.

As a reminder for all those that have been investing in whether it’s NFTs, Cryptopunks, Bitcoin, Ethereum, whatever, to be mindful of the tax rules there, and make sure that if you’re operating on Coinbase, PayPal, et cetera, they are sending 1099s to the IRS. So, don’t be in for surprise when tax season comes along there.

Anything else? I [00:17:00] think that this is a really good unpacking of this bill. It looks like we have not done a full phase out of the 199A, which is good. Their elimination of step-up in basis, which was a big deal for wealthy families, seems to be out of this initial proposal. Big, big rumblings on, on salt, and that’s the state and local tax deduction that hit hard. [00:17:30] A lot of the clients in this area, the Maryland, New York, New Jersey, Virginia, et cetera, that have higher property taxes. We’ll see what happens there. Again, we could debate the inequality and wealth gap and how to change that, and the views on some of these things that were left out. But, those are the things that were at the top of my list of things that I know people were concerned about from our first conversation in May, that didn’t make it to the bill. [00:18:00] And I think we’ve covered-

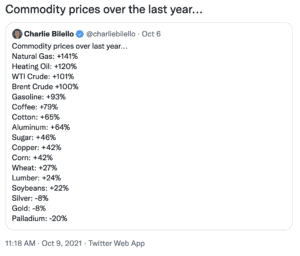

Shawn Donovan: And one more thing to add Brad, the estate exemption. There’s talks about lowering it from 11.7 million to five million, which could affect some people, especially with rising real estate values around the country right now. A lot of estates, a lot of parents that are dying, passing away, their estates might be in between that 5 million to 11 million dollar range now that real estate’s so much higher than it used to be. [00:18:30] So, you might want to keep an eye on that for estate planning purposes as well.

Brad Sherman: Right. And remember to check with the state laws, because a lot of the state laws are obviously lower than the federal exemption. If you’re doing your state planning and updating that leading up to it.

Shawn Donovan: Maryland being one of them.

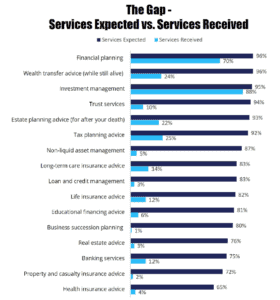

Brad Sherman: Maryland being one of them, of course, and DC as well. Make sure that you’re working in conjunction with all of your other esteemed [00:19:00] colleagues, whether that’s your estate lawyer, your CPA. If insurance is something that you want to discuss as a way to pay for a bill like this, some folks like to use insurance for that. Not recommending that as a strategy. But, having all of your players on your team understanding what’s in the law, bringing in estate’s tax, and of course financial planning would be the biggest, [00:19:30] but those are all good points.

Someone asked me, we have some New York clients that called right away and they said, well, what do we do? When’s the latest that something like this could pass? And then I was reminded of your horrible Christmas to New Year’s a few years ago when everything changed on a dime for you. We hope to not get you out of your Christmas pajamas to tell us that this has passed, but we hope to have you on again to follow [00:20:00] as this bill progresses through Congress and the changes that may or may not occur.

But I thought that this was a really great primer on what to expect and the changes that folks can think about. And the key takeaways to do between now and the end of the year seems like Roth conversions, and some ways to either through donor-advised funds, which we’ve talked about in the last episode. And of course, check out the episode of Elizabeth Goldstein on donor-advised funds. But it [00:20:30] seems like getting yourself through either charity or other deductions into this 400,000 range if you’re single, and 450 if you’re close on married filing jointly, will save a ton of tax. And might be beneficial to donate a couple thousand bucks just to save even more on tax.

We’ll be looking for individualized ways to help our clients. I know Shawn is always mindful of that as well. We’ll give you the final [00:21:00] word.

Shawn Donovan: I appreciate it a lot, Brad, for having me on again. And hopefully, we can do it again once we have finalized rules, and we know exactly the type of planning and tips and things that we need to have our clients do for the year 2021 and 2022. A lot of exciting changes though, for sure.

Brad Sherman: All right. Well, only a CPA would say that these changes are exciting, so that’s good to always have you on. Some of these scare me a little, and [00:21:30] I think what you said, the September 13th hard rule, I think will scare some folks.

Shawn Donovan: Absolutely.

Brad Sherman: As they’re in the middle of probably a lot of end-of- the-year transactions and preparation for what was anticipated for 2022. But, we really appreciate you coming on. We value your time and your opinion and advice. And, thank you to the audience for listening. Let us know what you think. Let us know, hit us up privately if there’s a specific issue that you want to [00:22:00] tackle. Or, if you think that this proposal impacts you directly, let us know.

And, as always, be well. Be safe. Hoping for a healthy continued school year. I know everyone on this microphone set is, between Shawn and I. And be well, everybody and we’ll talk to you soon.

Shawn Donovan: All right. Take care, Brad.

—