More snow coming?

Get ready for Instagrams and TV reports about empty bread shelves!

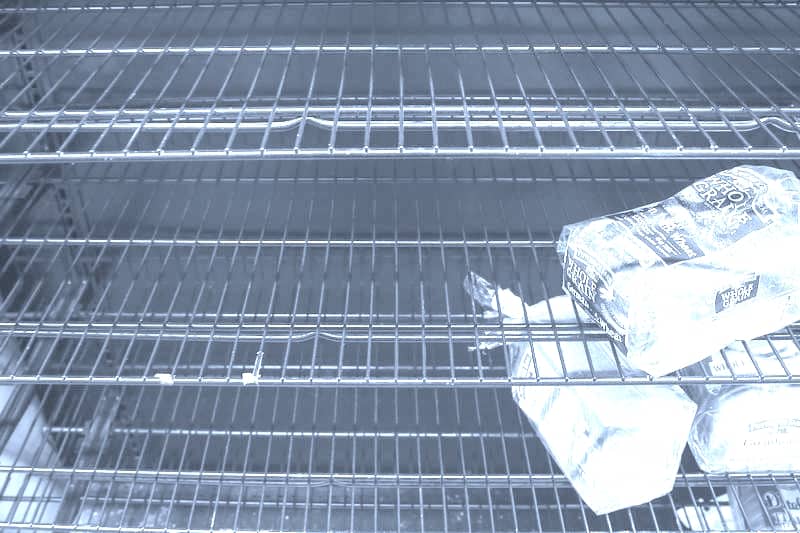

Here’s one from my local store before the blizzard a couple of weeks ago:

No matter how many people have resolved to stick to a gluten-free diet, that gluten seems much more appealing when a storm is on the horizon and gluten-free bread may get harder to find.

No matter how many people have resolved to stick to a gluten-free diet, that gluten seems much more appealing when a storm is on the horizon and gluten-free bread may get harder to find.

The same thing happens to investors. When the market is stormy, anxious investors often disregard their financial plans and start switching to what they perceive as “staples,’ sometimes at surge prices.

The trick with smart investing, as well smart shopping, is to make sure you’ve got enough of what you need – and want – before the storm hits, not during a run on the shelves. If you’re gluten-free, that means having a pantry already stocked with gluten-free pasta and a gluten-free loaf of bread in the freezer – not to mention beans, rice and tomato sauce – to tide you through the blizzard. It also means sticking to what you know has made sense for you in the past and realizing that two days without bread is not the end of the world – the bread will return to the shelves once the storm has passed.

Likewise, if you know your risk tolerance and have already planned effectively, you’ll have a balanced portfolio that contains the right balance of stocks and other less volatile instruments before a storm hits. With a fully diversified asset allocation strategy, there will be parts of your portfolio that go up, as well as other parts that go down, during times of stress. That way you’ll be comfortable sticking to your investment strategy and plan when the market is stormy. Plus, you’ll have purchased those less volatile instruments before pundits start shouting and everyone starts panic-purchasing.

A good financial advisor will help you build a portfolio strategy that truly for reflects your risk tolerance and, importantly, helps you understand exactly where the risk is in your portfolio. Your advisor will help you understand if, when and why to own bonds, Munis, Treasuries, and CDs, and how much of a cash component makes sense for your particular situation and need for liquidity.

The volatility we’re experiencing, current geopolitical uncertainty (like Japanese negative interest rates), and Federal Reserve uncertainty are all great litmus tests to determine whether you have a properly diversified portfolio and whether or not it’s an accurate match for your true risk tolerance. If current market conditions or any paper losses you may be experiencing make you feel uncomfortable – or keeps you up at night – it’s likely that your investment strategy does not match your actual risk tolerance and needs to be re-balanced.

If, however, you’ve worked with your financial advisor and are comfortable with where you, then you’re best bet is probably to ignore the noise, ignore the panicking pundits, and stick to your saving and investing plan. Remember, if your investments made sense to you a couple of weeks ago, they probably continue to make sense for you, even during market volatility.

Just like a diversified pantry will help you stick to your nutritional goals when there’s a run on the supermarket, a good fee-only financial advisor can help you create a portfolio that is truly diversified, risk appropriate, and with the exact amount of liquidity that makes sense for your long-term goals, so you can sit back and weather the storm with confidence.

Photo Source: Reuters/Shannon Stapleton

***