Has This Market Correction Changed Your Thoughts On Investing?

As you probably already know, it’s been quite a ride in the markets recently. When a stock index falls more than 10% from a recent high, it is often said to have entered “correction” territory. Has this recent market correction taught you anything about investing? As a young investor, this correction has been quite a learning experience, to say the least. From a sideline perspective and as an investor myself, watching the reactions of clients and peers around me has given me insight into behavioral discoveries behind investing. I’ve also seen how individuals deem their own comfortability with risk, especially within their equity.

Charlie Bilello posted an interesting blog discussing the difference between investing and merely speculating, whether people are “excited or nervous” when their favorite asset falls in price. He suggested that despite our natural panic response to the market crashing, when the market declines, it serves as an opportunity to reinvest in the market and add capital to your portfolio for the long term.

This is such a crucial mindset to have when approaching your investments, especially if you are investing for your future, with a long time horizon. If you were having trouble sleeping over the weekend and panicking Monday morning as the market opened, is it possible that you have too much equity risk and are investing money you may need in the short term? At Sherman Wealth, we consistently discuss the importance of time in the market versus timing the market, which should ease some of the panic during these market corrections.

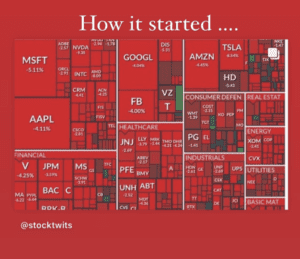

Another point to keep in mind is how quickly these fluctuations occur. We re-posted an interesting Stocktwits instagram story on Monday afternoon depicting how the equity markets started just after 9:30 in the morning and how they were going when the bell struck 4pm. You can see the clear fluctuations that often occur in a day of trading, and why you shouldn’t always assume the worst at the beginning of the day.

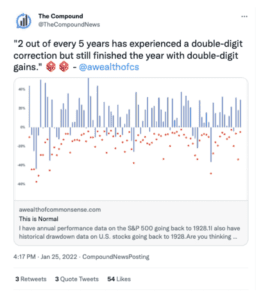

Furthermore, as we have seen time and time again, history repeats itself with corrections that happen constantly throughout the year. However, if you are a new or nervous investor, check out the data in the tweet below.

As the tweet describes, this is normal. Market corrections happen and will continue to occur for years to come. If you were excited or nervous this week during the market decline, that may be a good tell of your comfortability with your risk and overall portfolio. What also becomes apparent during these volatile times is the importance of having a sound financial plan. If you have any questions about your risk tolerance, fund line up, or the markets in general, we are here and happy to help you in any way we can. Send us an email at info@shermanwealth.com or schedule a complimentary 30-minute intro call here.