Rebalance Your Portfolio To Stay On Track With Investments

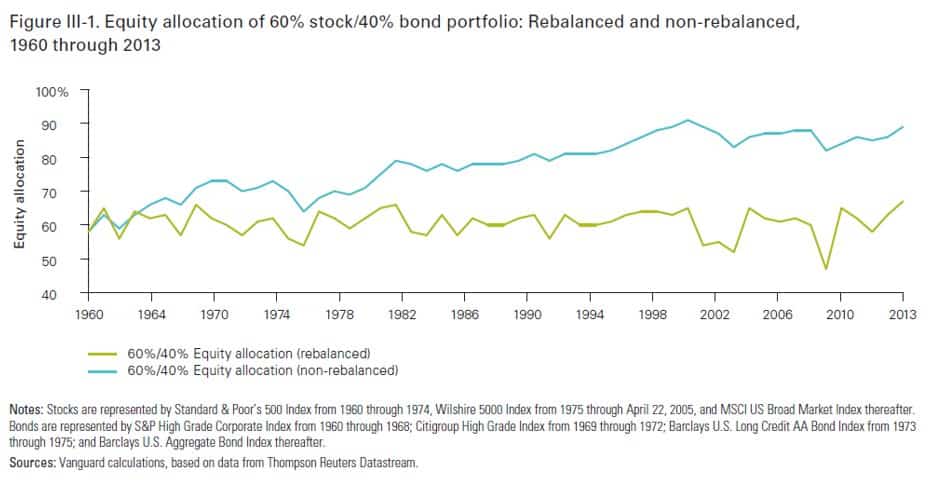

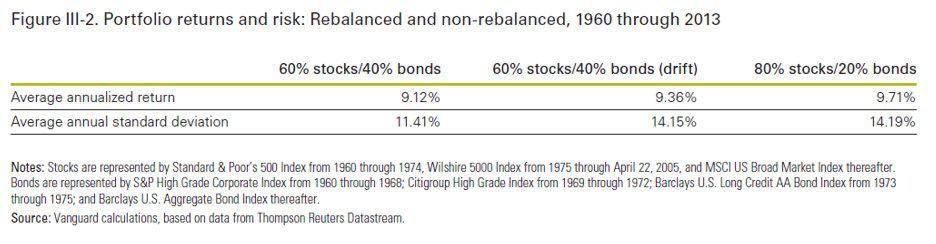

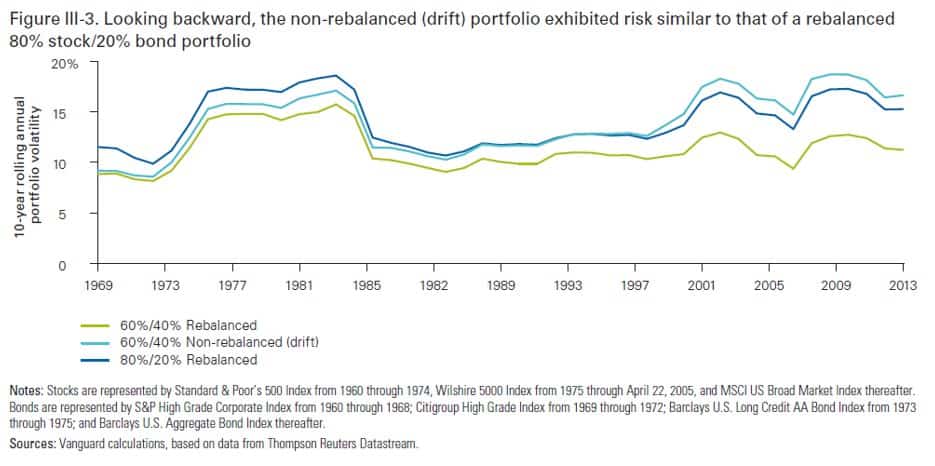

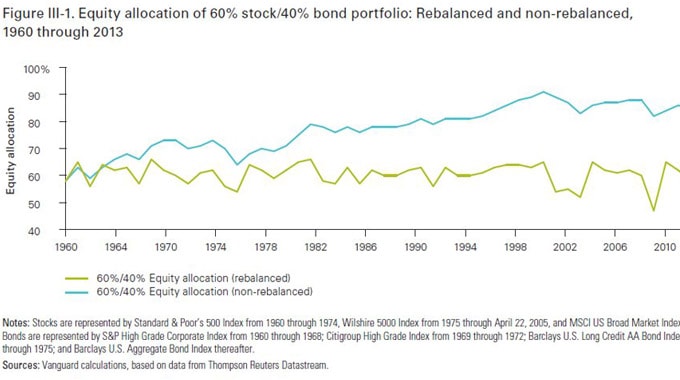

A drift portfolio 60% invested in stocks delivers risk comparable to a portfolio with greater market exposure, 80% invested in the stock market in the example of Figure III-2. This added risk from an unbalanced portfolio is not rewarded by a significantly greater return on your investment. Thus, a professionally balanced portfolio may help reduce risk that isn’t delivering a significant increase in return. Sherman Wealth Management understands that increasing potential risk without increasing the potential returns is unnecessary. It’s time to rebalance your portfolio to stay on track to help mitigate unnecessary risks.

“The S&P 500 Index is representative of domestic markets and includes the average performance of 500 widely held common stocks. This is a hypothetical example. Individuals cannot invest directly in any index and unlike investments, indices do not incur management fees, charges or expenses. Past performance is no guarantee of future results. The performance of indices would be lower if fees and charges were incurred.”

Learn more about our Investment Management services.

Related Reading:

Tips for Millennials to Understanding the Stock Market

What is Dollar Cost Averaging?

5 Big Picture Things Many Investors Don’t Do

Why and How to Get Started Investing Today

Mitigating Your Investment Volatility

The Psychology of Investing

Behavioral Investing: Men are from Mars and Women are from Venus!

LFS-958466-070114