Still haven’t won the Powerball?… Now what?

Still haven’t won the Powerball/? You may have to postpone that fantasy of buying a private island in Thailand, but that doesn’t mean you can’t still be on your way to achieving your financial goals and dreams.

Here’s one way to do it – take that money you’re sinking into lottery tickets and invest it instead.

Why are so many people willing to waste hundreds of dollars on a lottery they won’t win instead of investing it in capital markets that have shown growth over time? Many reasons. For some people, the hardest part of saving and investing could be just getting started. For others, it’s not understanding the benefits of compound interest and that even small amounts add up over time. For others it may be fear of volatility and distrust or the markets from listening to too much CNBC, Fox Business, and Bloomberg!

While it’s true that markets have dipped significantly in January, market dips are a potential opportunity to buy low and earn higher returns over time. The bottom line is that, for most people, even those starting with modest amounts, keeping money in cash is generally not a winning proposition.

Here’s why:

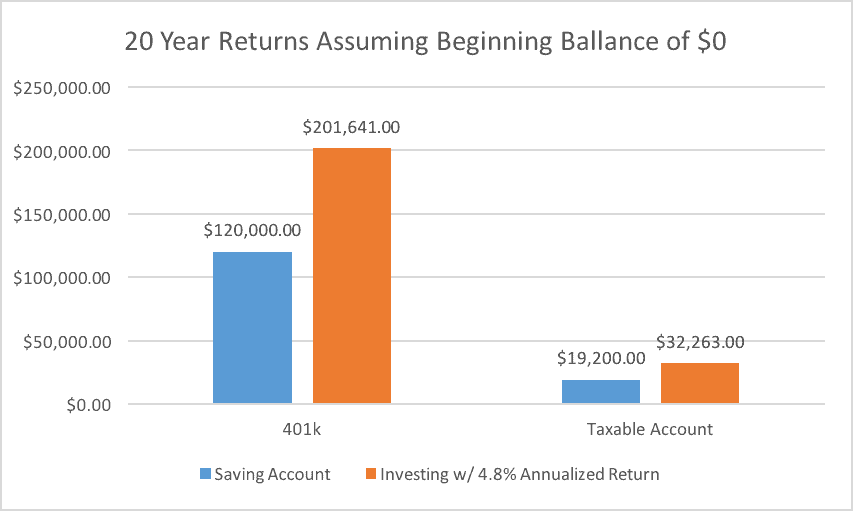

Lets say you are contributing $250 each month ($3k/yr) to your 401k plan with a 100% company match and invest it in a diversified basket of stocks and bonds based on your risk tolerance. At the same time, you save and invest $20 a week (the cost of 10 Powerball tickets a week) in a regular investment account. Assuming historical 4.8% annual returns*, here is how your money will grow over a 20-year period (in today’s dollars) vs. saving the same amount as cash:

*based on a diversified portfolio that assumes the following weights: 25% in the S&P 500, 10% in the Russell 2000, 15% in the MSCI EAFE, 5% in the MSCI EME, 25% in the Barclays Aggregate, 5% in the Barclays 1-3m Treasury, 5% in the Barclays Global High Yield Index, 5% in the Bloomberg Commodity Index and 5% in the NA REIT Equity REIT Index. Balanced portfolio assumes annual rebalancing. All data represents total return for stated period. Past performance is not indicative of future returns. Data are as of 12/31/15. Annualized (Ann.) return and volatility (Vol.) represents period of 12/31/99 – 12/31/15. Source: Page 59 https://www.jpmorganfunds.com/blobcontent/202/900/1158474868049_jp-littlebook.pdf

So go ahead and keep dreaming about that island! But first speak with a financial advisor about your current situation and future goals and what the best steps are to start working towards financial freedom.

And when the next Powerball comes around? Our guess is that a good financial advisor can help you find better ways to let that $2 grow for you!

***