Weekly Market Review 12/14/2018

Domestic markets endured another uneventful week, with two of the three major US indices posting losses over 1% for the period. Coming into the month of December, we were told how, historically, this is a bullish time of year for equities. Unfortunately, “historically” is just another term for “average” and while December may typically be a strong month, that was not the case this year. It’s usually a positive month, rarely negative. But it looks like 2018 will not see a normal December, which would make sense considering how the full year has played out in general.

Trade tariffs continue to garner the most attention in headlines. The market tends to have large, upward swings on positive news regarding the US-China debacle, but they are short-lived, as many feel these positive updates simply fall into the “boy who cried wolf” category at this point. We may not see a sustained move in either direction (up or down) until some kind of formal agreement has been reached between the two parties.

To add to the worries, signs from abroad have not been much better. British Prime Minister Theresa May has fallen on tough times in regards to her Brexit battle, now fighting for her own political life. This week, a right-wing faction in her own party triggered a “no confidence” vote following May’s decision to postpone the debate over a deal that could have finally brought closure to the issue as a whole, which initially arose over two years ago. In China, weak economic data shows that the trade tensions are severely affecting their economy, with weaker than expected industrial output and retail sales numbers. On top of this, the reports out of Europe weren’t any better. In fact, the German and French private sectors (arguably the two most important in the Eurozone) are trending downwards in terms of growth. Further, Italian debt issues keep the country on the brink of recession. Despite the headline worries and weak economic showings in foreign economies, the US data continue to produce strong numbers, although some areas are starting to slow. Retail sales remain high, while manufacturing and service sectors output fell to new lows. We are still in an expansion, albeit at a slower than what we have been accustomed to over the past few years.

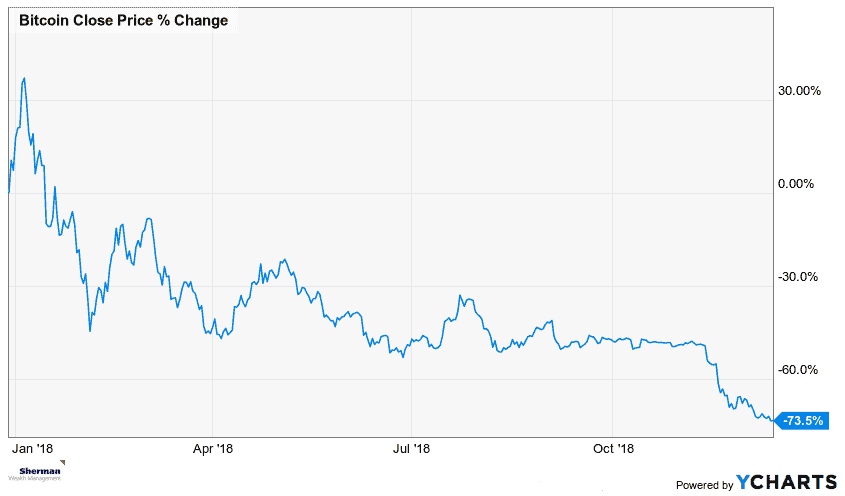

Where is Bitcoin?

Last year’s favorite asset, Bitcoin, is now down over 70% on the year, back to the $3300 area we saw last July 2017.

If your goals for your assets have changed, if you believe your risk tolerance may not be in line with the drawdown you’ve seen in your portfolio recently, or if you just want to talk about your individual situation this is a great opportunity to let us know.